Rail Capacity Report – 11/1-11/7/2022

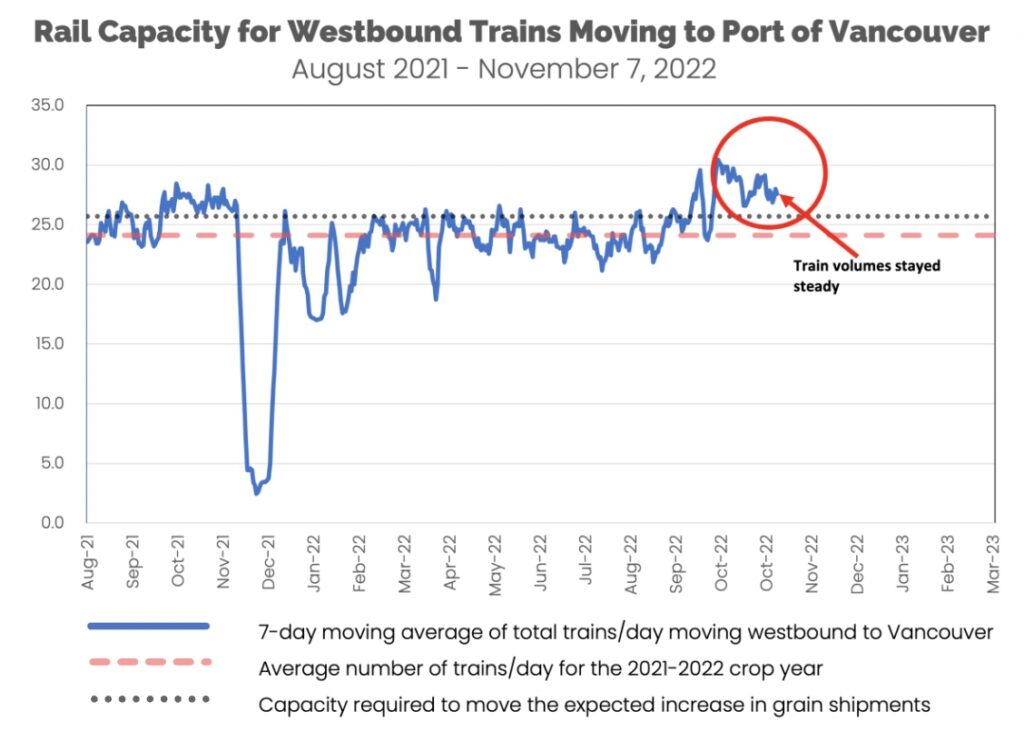

With a larger grain harvest expected this year, our customers and others are concerned about rail capacity at the Port of Vancouver. Last year’s harvest saw ample service disruptions and delays, due to fires, flooding, and other issues. There were also capacity issues caused by insufficient train crews and operating disruptions that affected all commodities.

Observations for Week 11/1-11/7/2022

- For most of 2022 the railways’ train volume has been below the amount required to move the current grain harvest.

- At the end of this past week (11/1-11/7/2022), the 7-day moving average number of trains moving westbound past Chilliwack was 27.6 trains/day, above the average of 25.7 trains/day that is required to move a typical grain harvest.

- The moving average number of trains/day was above 25.7 trains/day for all 7 days during this past week.

- As of 11/7/2022, the 7 day moving average for total trains was the same as it was on 10/31, at 27.6 trains/day.

Summary

For the past seven weeks, the railways have appeared to be doing well with movement toward Vancouver. Total train volume is above the 25.7 trains/day required to move the current grain harvest, and the typical volume of other commodities. Most of the additional trains above the year-to-date average are grain trains.

We estimate that about 5 grain trains/day are required to move the expected grain harvest. For the past week, the railways moved 7.6 grain trains/day, a decline from the high of about 9 grain trains/day achieved earlier in October, but still well above the required average. For the third week in a row, the volume of coal trains (5.0 trains/day) was close to its long-term average of 5 trains/day, rather than being significantly below average, as was the case earlier this fall.

In addition to grain, manifest and coal traffic are at or above their long-term average levels. As of 11/7, the intermodal and potash traffic was slightly below the long-term averages for those categories, at 6.7 trains/day and 1.3 trains/day, respectively. However, it’s important to note that Petroleum traffic declined significantly over the week ending 11/7, falling from an average of 2.4 trains/day as of 10/31 to only 1.4 trains/day as of 11/7 (significantly below the long-term average of 2.2 trains/day.)

We will continue to monitor the Grain Harvest in Canada on a weekly basis, and provide updates on trends we’re seeing.

Subscribe to our blog for updates every Wednesday.