Rail Capacity Report – 11/15-11/21/2022

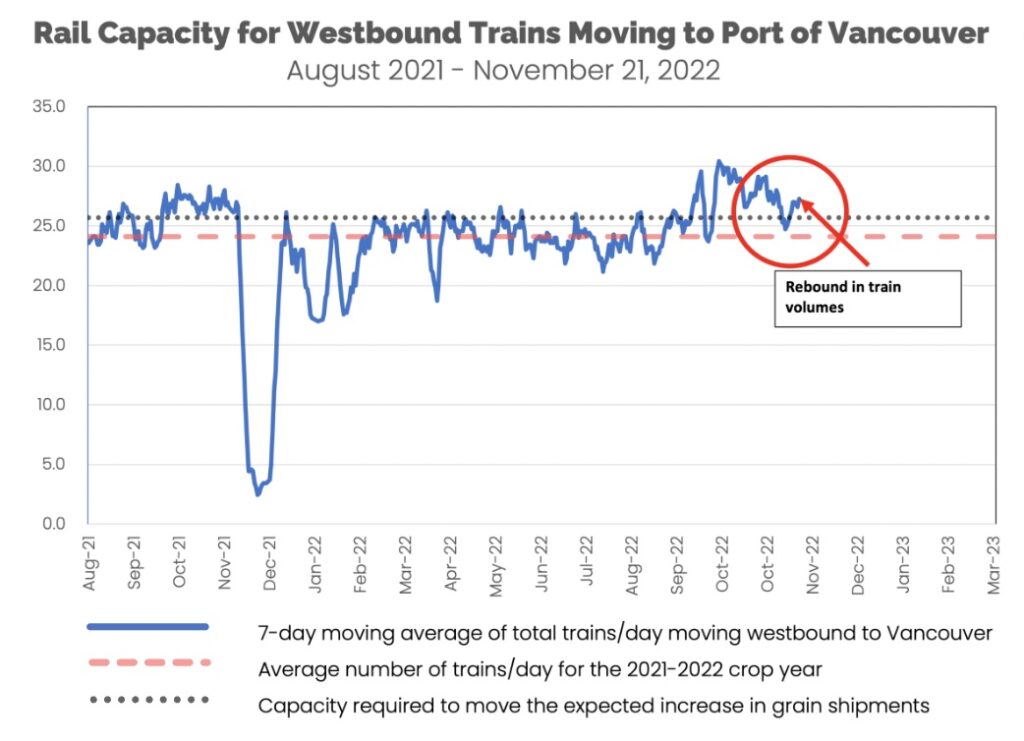

We’ve been reporting on the Grain movement in Canada to the Port of Vancouver for the last nine weeks. For most of this period, the railways have appeared to be doing well with westbound movements toward Vancouver. The past week (ending 11/21/2022) was a continuation of that trend, with total train volumes rebounding to 27.3 trains/day, which was significantly above the 25.7 trains/day required to move the current grain harvest and the typical volume of other commodities. This also represented an increase of 1.9 trains/day from the temporary low of 25.4 trains/day that occurred during the previous week (ending 11/14/22).

Observations for Week 11/15-11/21/2022

- The 7-day moving average number of trains moving westbound past Chilliwack was 27.3 trains/day, significantly above the average of 25.7 trains/day that is required to move a typical grain harvest.

- The moving average number of trains/day was above 25.7 trains/day for all 7 days during this past week.

- During the week ended 11/21/2022, the 7 day moving average for total trains increased by 1.9 trains/day from the previous week, from 25.4 to 27.3 trains/day.

We estimate that about 5 grain trains/day are required to move the expected grain harvest. For the past week, the railways moved 8.9 grain trains/day, near the high of 9.4 grain trains/day achieved in October, and well above the required average.

However, most of the increase in traffic during the week ending 11/21/22 consisted of additional grain trains, which accounted for 1.8 trains/day out of the 1.9 trains/day increase in overall volumes. Intermodal (6.4 trains/day), coal (3.6 trains/day), potash (0.9 trains/day) were all below their long-term average levels, with intermodal traffic levels remaining flat over the past week, and coal and potash traffic seeing small declines from the previous week. Aside from grain traffic, only manifest trains (4.1 trains/day), petroleum (2.4 trains/day), and other traffic (1.0 trains/day) were also at or above their long-term average levels as of 11/21/2022, with all of these categories seeing small increases in volume compared to the previous week.

We will continue to monitor the corridor to Vancouver during the grain season and provide updates on trends we’re seeing.

Subscribe to our blog for updates every Wednesday.