Visibility with RailState: It’s Time for Rail to Join the Visibility Game

What do we mean when we say “rail visibility,” and why does it matter? Think of it this way: when you drive your car, you might use an app — like Google Maps or Waze — to see what your route looks like. If there’s congestion on your usual route, you might take a proposed alternative. You’re able to refer to the app to see an updated ETA, as traffic patterns change. No surprises here! You’ll (likely) arrive when expected. In terms of shipping: trucks have enough visibility to make strategic decisions while en route, which is why trucking is often a more dependable mode of transport than rail.

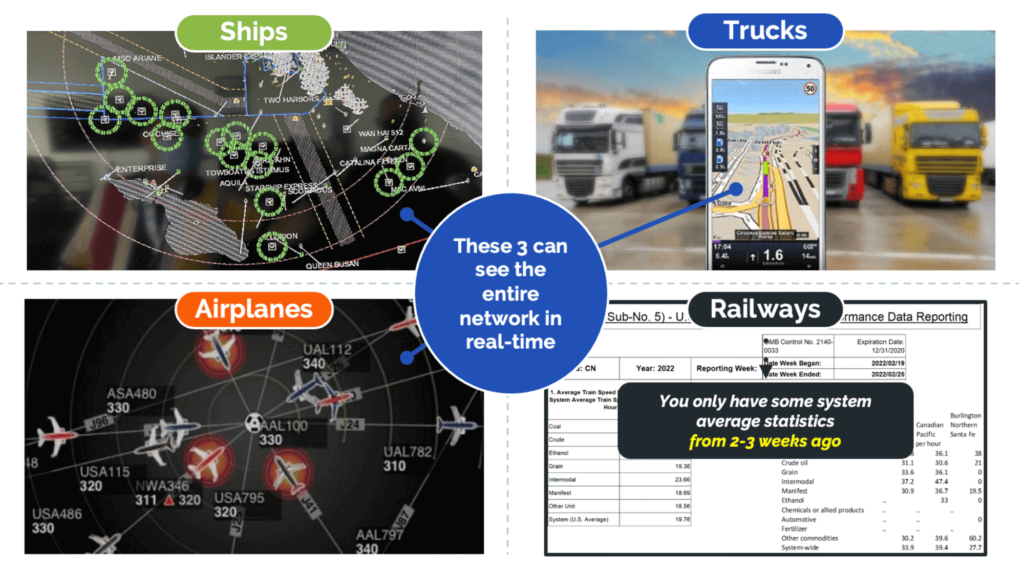

Ships and airplanes also have network visibility; and they can always see what’s going on, and where there might be congestion or problems. This allows the ships to change to a different port, if necessary, or the airplanes to switch to another airport. While this doesn’t happen often with airlines, any sudden event — storms, for example — might cause the planes to need a new place to touch down. Visibility is crucial in this instance.

When it comes to the railroad: you can trace your car and get an estimated ETA based on system average statistics, likely from two or three weeks ago. Unlike the other modes of transportation, there aren’t real-time updates on what the rail network looks like ahead of your shipment.

Say there’s a derailment — how would you know the cause and the effect? Is there a washout? Are trains being delayed? All you’d know is where your car was in the last 24 hours. It could still be sitting there, not having moved. You’d have no way of knowing.

We’re trying to fill this visibility gap. RailState’s data affords customers the same amount of visibility for rail that’s possible for the other modes of transportation. Our real-time data provides insight into the entire network — i.e. everything that’s moving by rail. When you have network visibility, you have control over your shipments and operations. More control equates to less time and money lost to inefficiencies.

It’s time for rail to catch up. See what’s up ahead, with RailState.: