What You Can Do:

How To Reduce Your Risk

With the railroads unable to make up volumes after a disruption, your missed shipments could become permanent losses.

These losses, however, will not be shared equally. Some lanes are more resilient than others – they have more current capacity in terms of crew availability, locomotives, train capacity on existing trains, and number of trains to move more volumes before a strike and return to normal service after a strike. That available capacity will be used by those who plan ahead and can identify the best ways to keep shipments moving before, during, and after a disruption.

To minimize your potential losses, it’s up to you to take action as early as you can.

That means understanding the state of your rail supply chain, thoroughly analyzing the options available, and implementing the strategies most likely to succeed. There are a number of strategies you could implement to mitigate the impact of a national strike. The three that rail shippers use frequently are:

Strategy #1 – Ship Early

Shift inventory and/or accelerate production and secure available rail capacity to send shipments before the start of a strike.

Strategy #2 – Alternative Routing

Use optionality you have created through strategic investments such as:

- different railways

- multiple ports/terminals

- warehouses and transloads

- multiple manufacturing facilities

- temporary storage facilities

Strategy #3 – Shift to Trucking

Move shipments to trucks as needed when rail capacity is unavailable.

*A fourth strategy is to do nothing and hope for the best.

This is the strategy many rail customers take. It is not recommended. A national rail strike may be avoided in the coming months but significant disruptions on the rail network that last days or weeks are regular occurrences. Accepting the unreliability of the rail network and incorporating losses into your annual plan is easy. It does not have to be inevitable. Proactive planning with the right tools and information can help you minimize losses during disruptions and seize opportunities to increase sales.

Creating a Risk Mitigation Plan

With real-time rail network insights from RailState you can evaluate any of the strategy options. Our expert staff can also help you understand how to use our tools to execute those strategies. For most companies, moving only one shipment that otherwise would have been missed will generate a 3x – to 10x ROI.

Step 1: Understand Your Company’s Risk

- Where are you in your current shipment plan?

- Are you behind due to internal operations or previous rail disruptions?

- What is the potential revenue loss from one day of missed shipments? Two days? More?

Step 2: Review Inventory and Production Adjustments

- Do you have enough inventory to ramp up shipments quickly?

- Can you accelerate your production schedule?

- Will your customers accept earlier shipments?

- Can your facility handle additional railcars?

Step 3: Evaluate Strategy Options

- Is it possible to ship early?

- Are alternative routes available?

- How do increased costs from trucking compare to potential losses from missed shipments?

Step 4: Execute

- Deploy the strategy or strategies most likely to succeed

Taking Action – Manifest Shippers

Who: Companies that ship by carload. Producers in energy, lumber, chemicals, automotives, and other products.

Risk from one lost carload: C$10,000 to C$100,000

Strategy #1 – Ship Early

Insight you need: Is there available capacity on your routes?

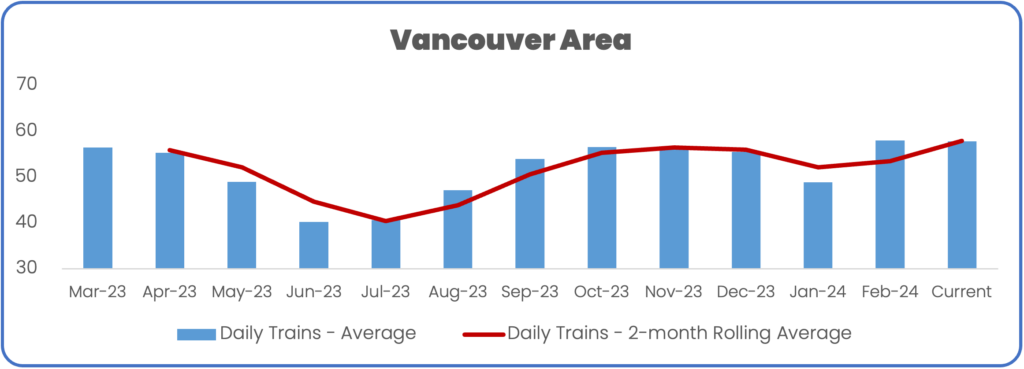

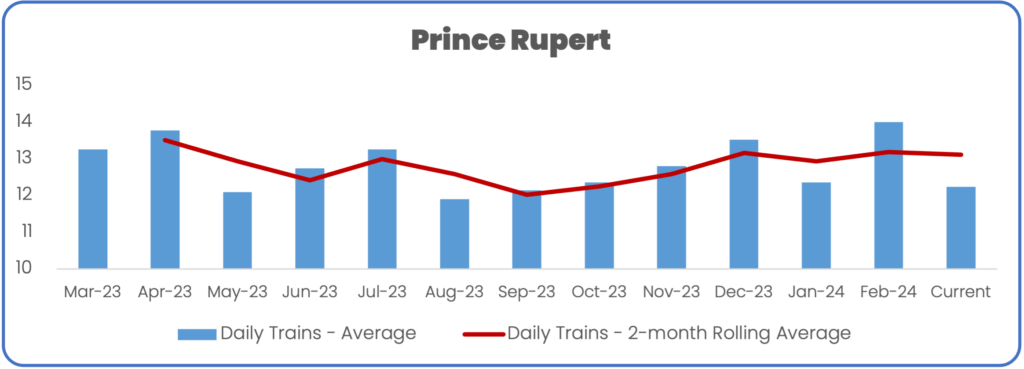

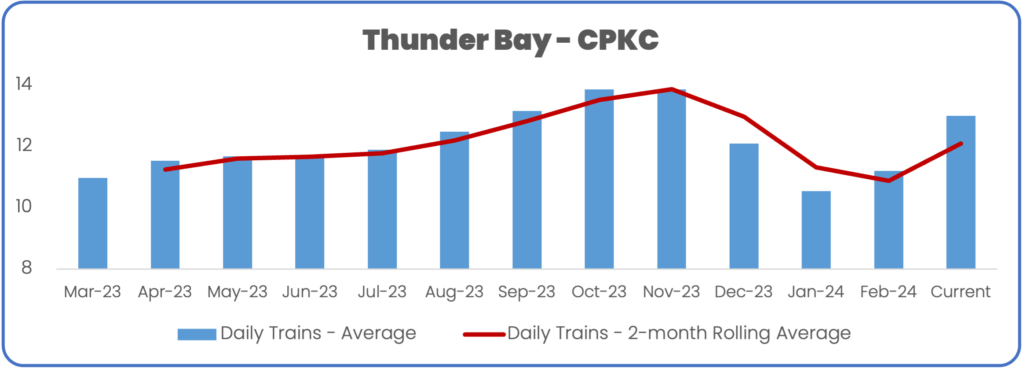

How to Evaluate: Review trends on your routes using RailState data

- Manifest train volume for the previous 30, 90, 180 days

- Manifest train length over the same period

If train volume in recent periods has been higher than the current volumes, or train length has been greater than current lengths, there could be incremental capacity available to you.

For railroad-supplied cars, identify empty car pipeline:

- Count and location of cars (e.g. boxcars, gondolas, flatcars) incoming to your facility

- Estimated travel time to facility

Action to take:

- Discuss with your rail carrier plans to ship ahead and provide forecast volumes.

- Request additional cars from railroad based on knowledge of likely empty car volume and distance from your facility.

- Compare additional costs to risk of lost shipments.

Strategy #2 – Alternative Routing

Insight you need: Is there available capacity on your alternative routes?

How to Evaluate Review trends on alternative routes and to all your destination areas using RailState data

- Manifest train volume for the previous 30, 90, 180 days

- Manifest train length over the same period

If train volume in recent periods has been higher than the current volumes, or length has been greater than current lengths, there could be incremental capacity available to you in some of your lanes.

For railroad-supplied cars, identify empty car pipeline:

- Count and location of cars (e.g. boxcars, gondolas, flatcars) incoming to your facility

- Estimated travel time to facility

Action to Take:

- Modify shipping strategy if possible, shift shipping locations, prioritize your shipments on lanes with potential capacity.

- Discuss with your rail carrier plans to ship ahead and provide forecast volumes.

- Request additional cars from railroad based on knowledge of likely empty car volume and distance from your facility

- Compare additional costs to risk of lost shipments

Strategy #3 – Shift to Trucking

Insight you need: When has capacity returned to normal?

How to Evaluate:

- If there is not likely to be available rail capacity for Strategy #1 and #2, shift to trucking early.

- During recovery Monitor capacity on your routes and alternative routes to know when performance returns to normal

- Monitor empty car pipeline to identify sufficient supply

Action to take:

- Secure truck capacity before competition, at better rates.

- Return to rail service with optimal timing to eliminate the additional cost of premium transportation as soon as possible.

>>>>> How to identify empty car supply <<<<<

Taking Action – Bulk Shippers

Who: Companies that ship by the trainload. Commodity producers in coal and energy, potash/fertilizer, and grain products.

Risk from one lost carload: C$5million to C$10million (or more)

Strategy #3 of shifting to trucking is generally not available to bulk shippers. The higher cost of trucking at the large quantities needed to be shipped make trucking not economically viable in most situations.

Strategy #1 – Ship Early

Insight you need: Is there available capacity on your routes?

How to Evaluate:

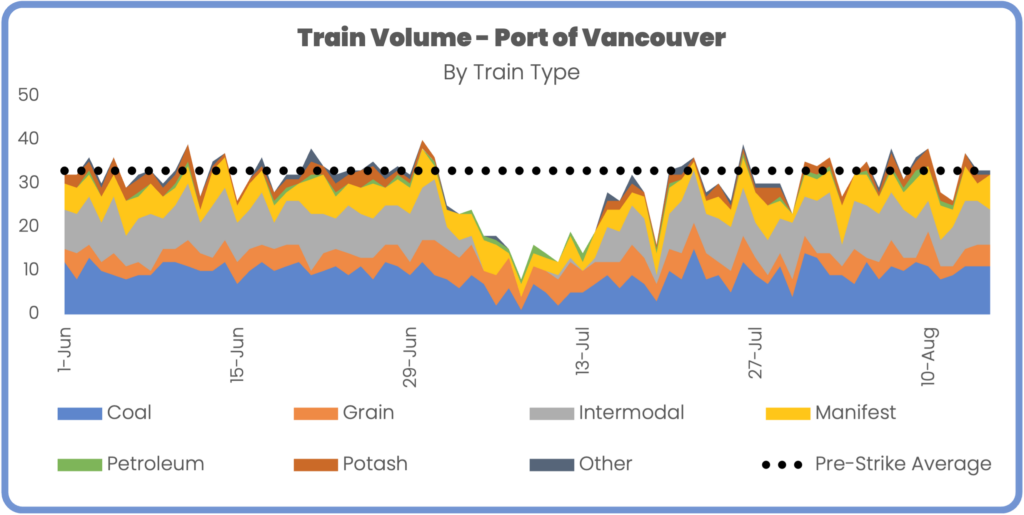

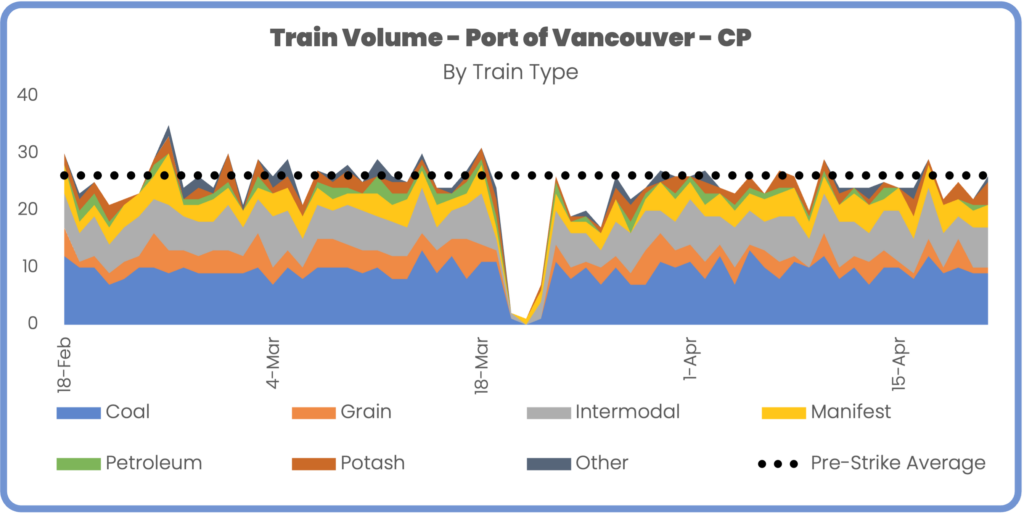

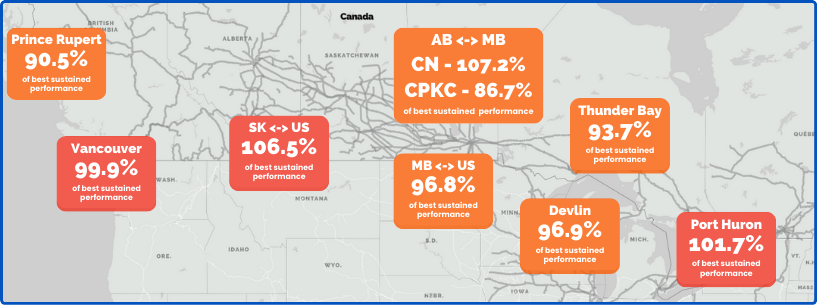

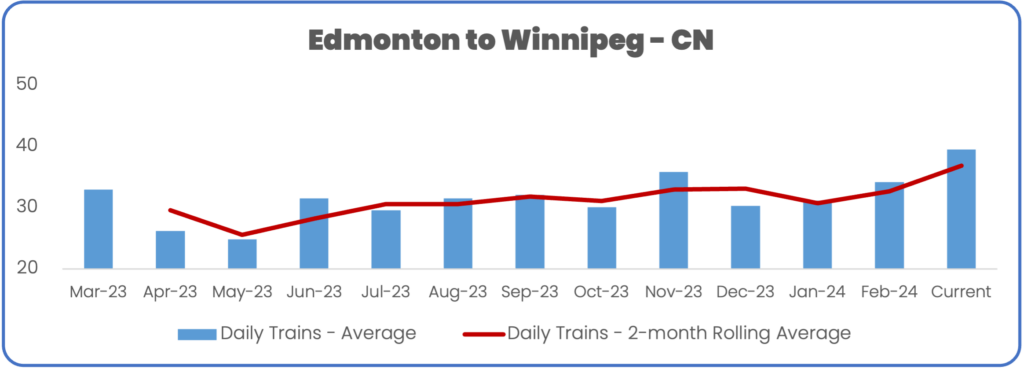

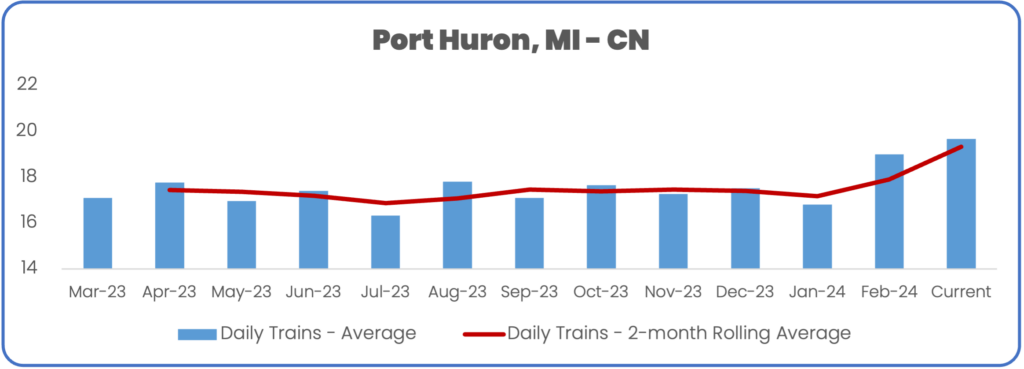

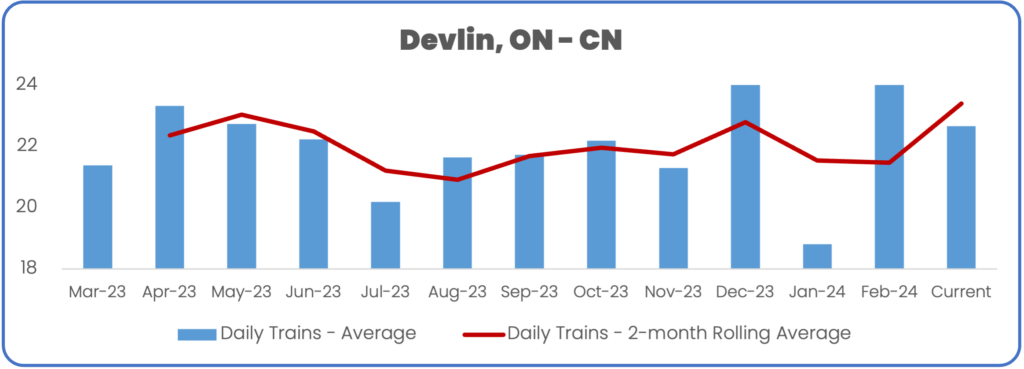

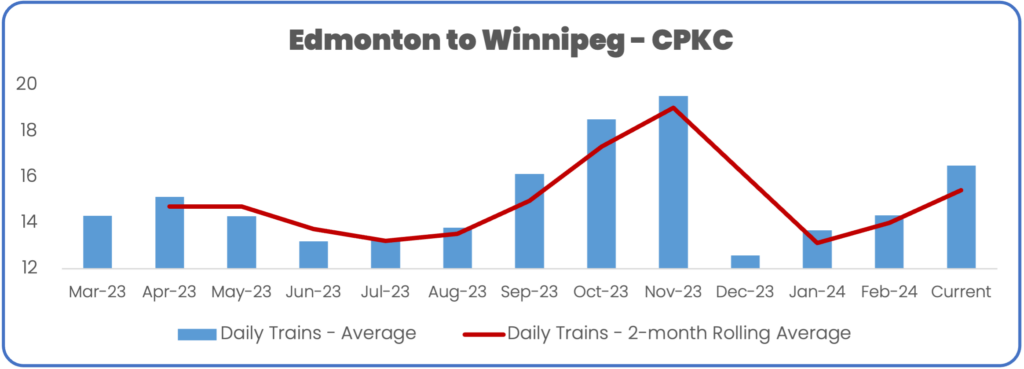

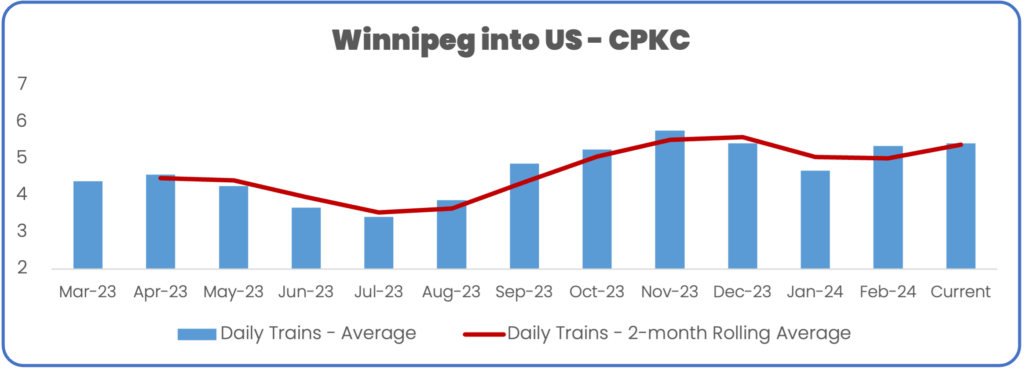

- Train volume for the previous 30, 90, 180 days

- Mix of train types (coal, grain, potash, intermodal, manifest) over same period

- Transit times by train type

If train volume in recent periods has been higher than the current volumes, even if for a few days or weeks, there could be incremental capacity available to you.

Action to take:

- Approach the railway about shipping ahead. You have data now that indicates there may be capacity on this line. Work with them to schedule your additional shipments at times they can best handle it.

Strategy #2 – Alternative Routing

Insight you need: Is there available capacity on your alternative routes?

How to Evaluate:

- Identify potential alternative routes and review trends trends on your routes using RailState data:

- Train volume for the previous 30, 90, 180 days

- Mix of train types (coal, grain, potash, intermodal, manifest) over same period

- Transit times by train type

If train volume in recent periods has been higher than the current volumes, even if for a few days or weeks, there could be incremental capacity available to you.

Action to Take:

- Approach the railway about shifting volumes to alternative origins, destinations, or routes (e.g. different port, different mine than planned) You have data now that indicates there may be capacity on this line. Work with them to schedule your additional shipments at times they can best handle it.

Strategy #1 and #2 in Action

July 2023 Dockworkers’ Strike: Accelerated Shipments and Alternative Routes

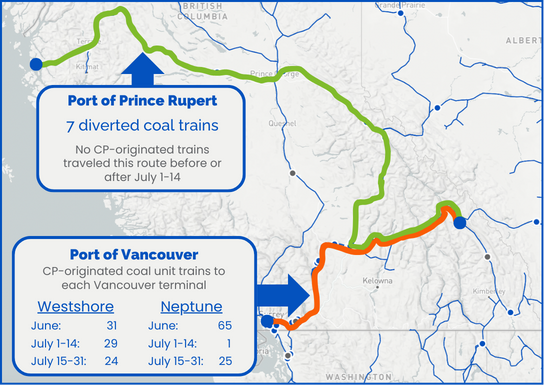

In July 2023, a labor stoppage at the western ports curtailed the majority of export flows. Some commodities, however, were still able to move. Canadian law requires that most grain continue to move for export during this kind of work stoppage.

Westshore Terminals, an export terminal dedicated to coal, in Vancouver and one terminal at Prince Rupert, were not subject to the same labor agreement as the other western terminals experiencing the work stoppage. That meant that the railroad capacity through British Columbia remained the same as before the strike. It was demand that fell.

Rail routes in British Columbia now had significant excess capacity, and some bulk shippers took advantage. Grain shippers moved product earlier than usual and also moved more grain to Prince Rupert that would typically go to the Port of Vancouver. Grain train volume increased 78% to Prince Rupert and 22% to Vancouver during the labor stoppage.

Coal shippers with agreements on both CN and CPKC used alternative routes to send coal on a much longer journey to Prince Rupert instead of Vancouver (which had a constrained ability to export coal with only one terminal operating).

Coal train volume to Prince Rupert increased 52% while coal traffic to Vancouver fell 37% during the work stoppage. This coal shipper incurred increased costs from the longer route but moving seven additional coal trains during this period was worth tens of millions of dollars in profit.