Cross-Border Rail Volumes – March 3, 2025

RailState, the industry’s only provider of rail network intelligence independently monitors cross-border train movements in real-time.

With tariffs on goods from Canada and Mexico set to start on March 4, we’re monitoring the impacts to the rail supply chain as they happen.

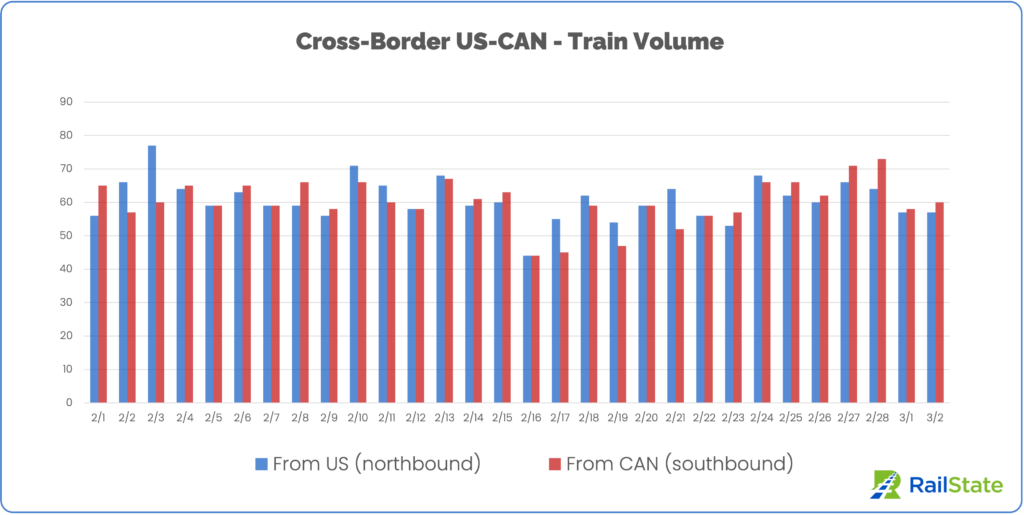

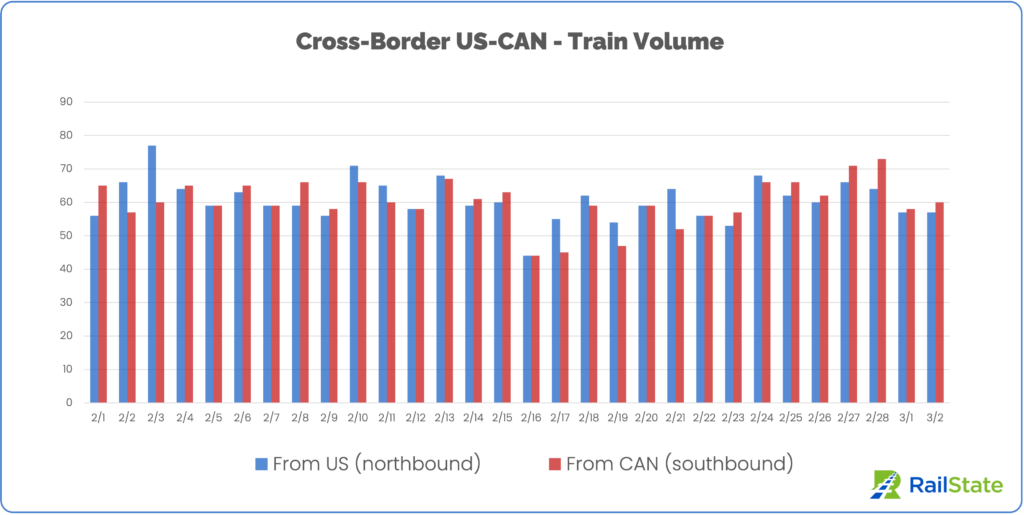

Train volumes from Canada across all border crossings remained below the 30-day average on March 2.

Northbound volumes from the US on March 2 were also down 4% from the average.

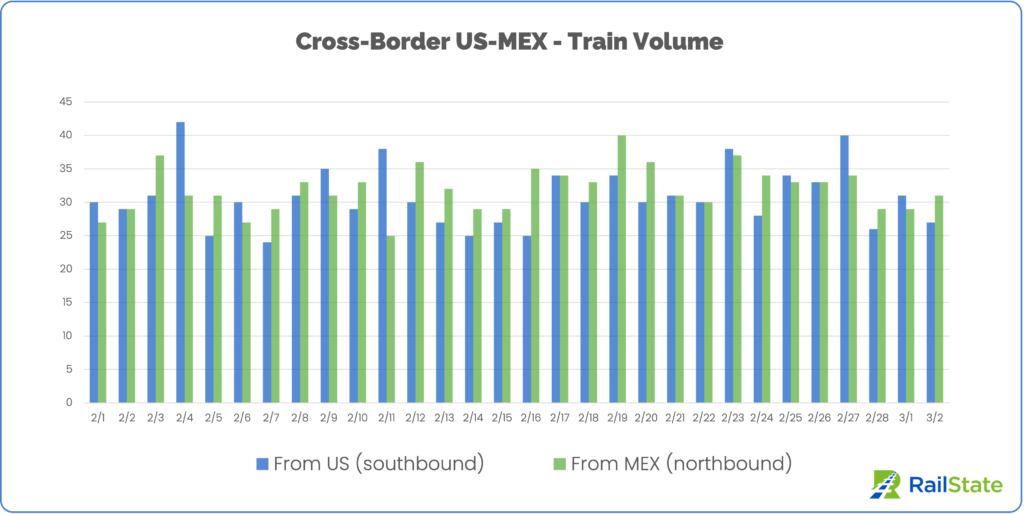

Train volumes from the US into Mexico were 4% below the 30-day average on March 2.

Northbound train volumes from Mexico to the US were up modestly (+4%).

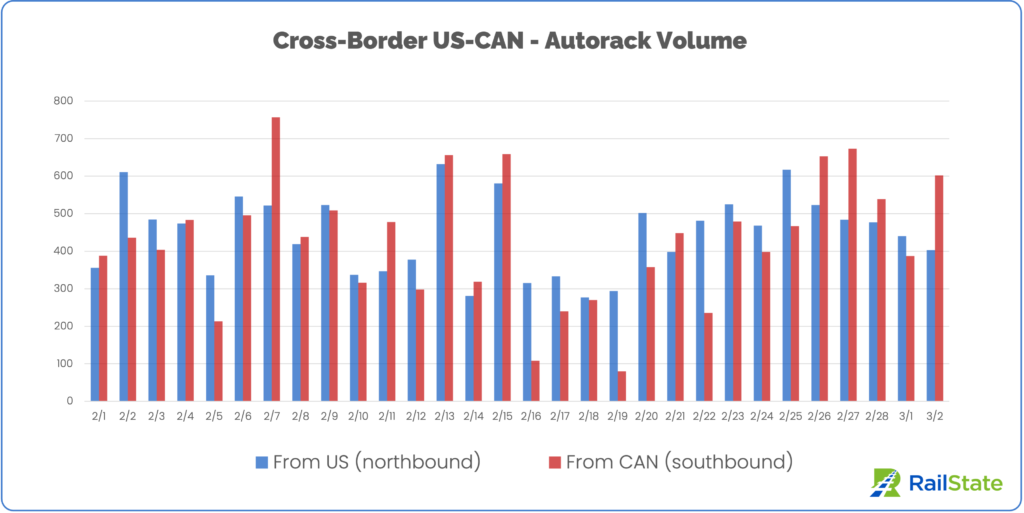

Autorack volumes from Canada jumped 18% from the 30-day average on Mar 2, more inline with the recent surge from 2/26-2/28.

Volumes into Canada from the US decreased slightly, dropping 8% from the recent average.

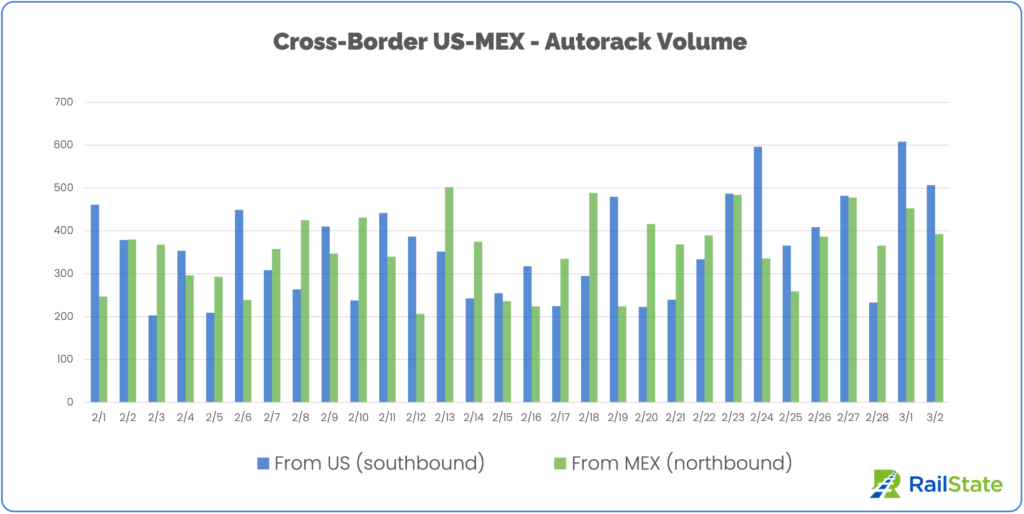

Autoracks from the US into Mexico remained high on Mar 2, 13% above the recent 30-day average.

Northbound autoracks from Mexico fell slightly, dropping 3% from the recent average.

For additional information about this report or to receive other updates from RailState, please reach out to contact@railstate.com or subscribe to our blog.

Schedule your in-depth demo today to explore how Rail Network Intelligence can unlock insights for your rail supply chain.

Copyright © 2025 RailState LLC