Canada Intermodal Rail Volume Report: December 2023

RailState, the rail industry’s only provider of real-time rail network visibility, independently tracks all freight rail movements across Canada in real-time.

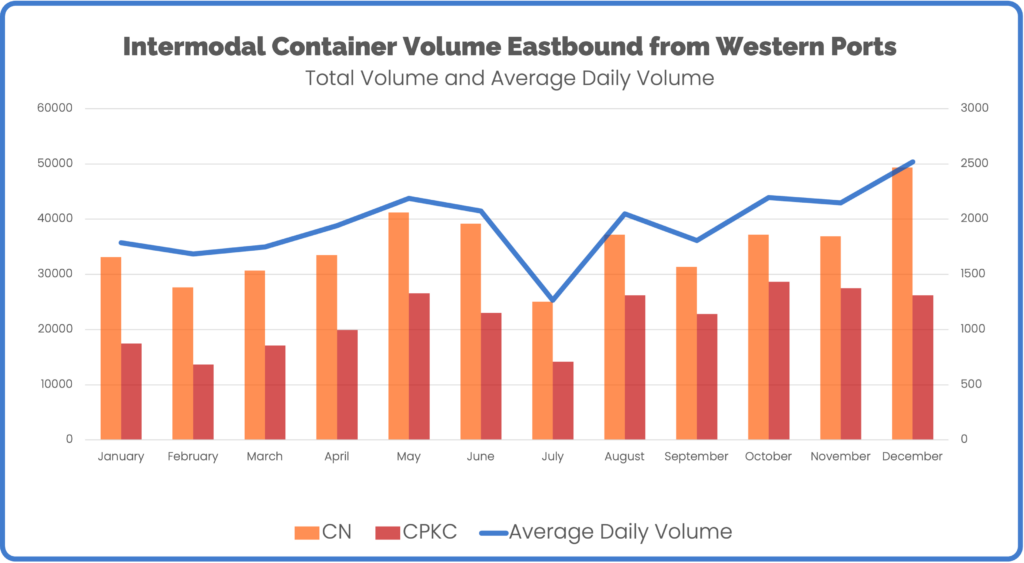

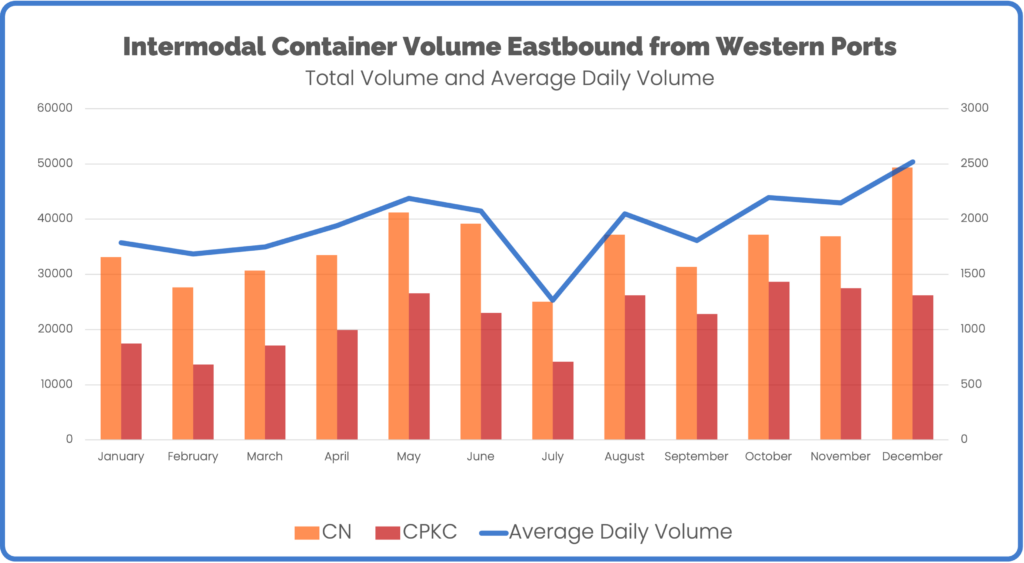

Total average daily volume headed eastbound from the Western Canada ports grew 17.4% in December compared to November.

CN increased international intermodal volume 33.7% in December while CPKC decreased 4.5%. While CN has maintained a significant market share advantage for international intermodal from the western Canada ports, the trend was moving in CPKC’s favor in recent months. December showed a reversal in this trend. CN’s share of international intermodal from the western ports hit 65% in December, up from 57% in November.

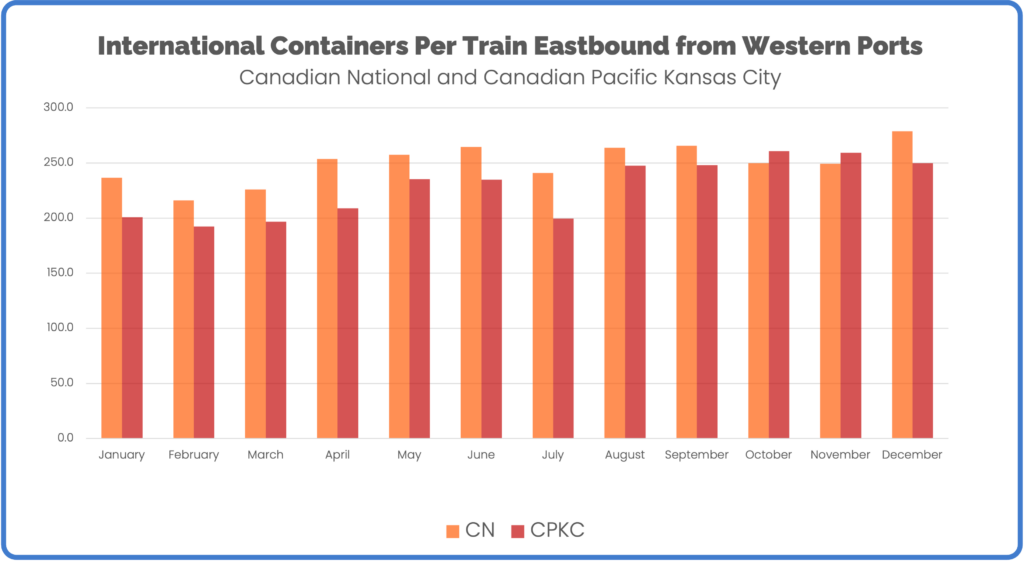

Explaining some of the growth in container volume for CN was increased train size. CN carried 30 more containers per train in December than in November, a 11.8% increase. CPKC moved 10 fewer containers per train in December, a 3.6% decrease from November.

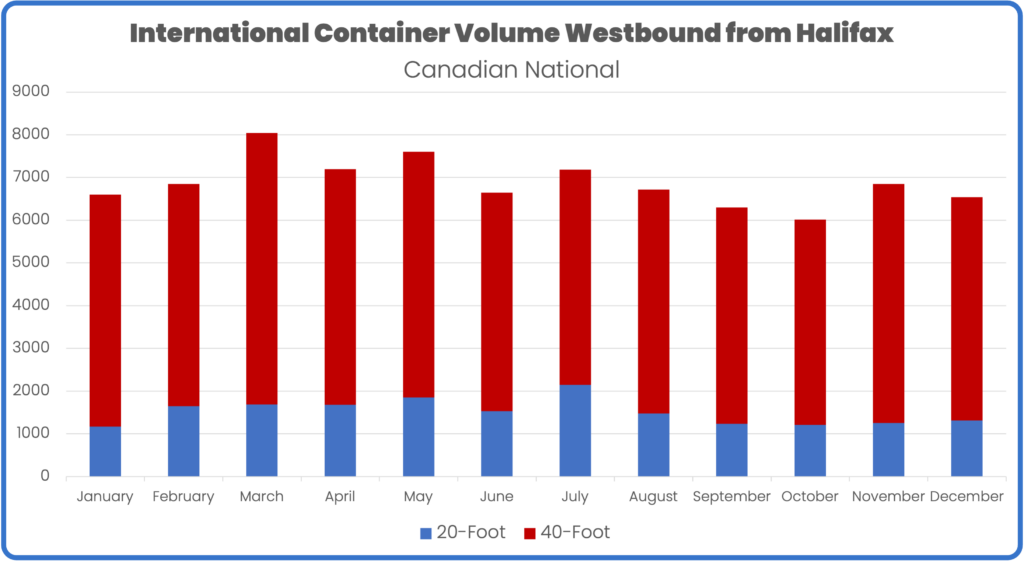

International container volume through Halifax declined slightly in December, decreasing 4.5% from the previous month.

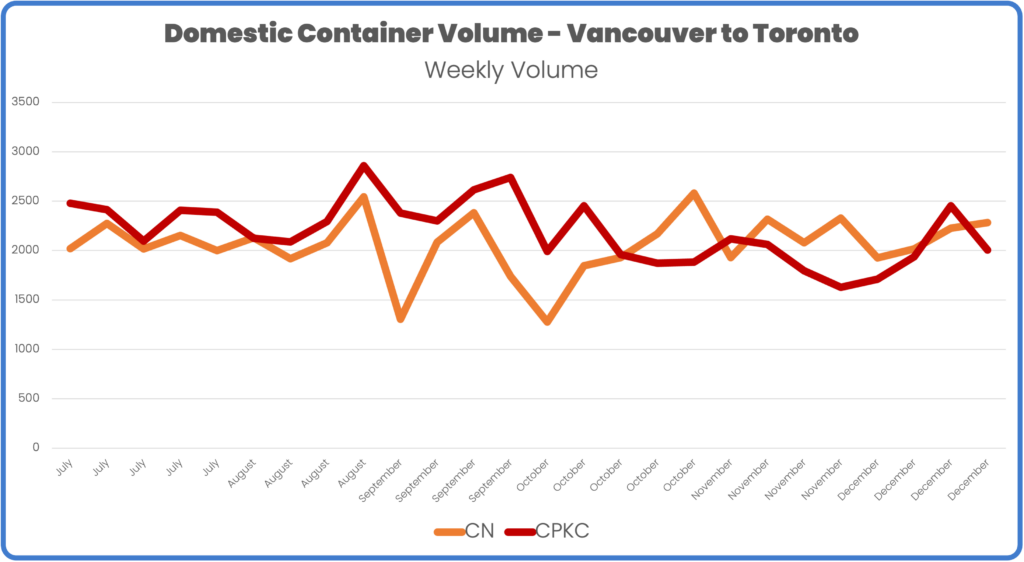

Weekly container volume moving from the Port of Vancouver area to the Toronto area increased through most of December before some declines in the final week of the year. In December, CN moved an average of 2114 domestic containers per week from the Vancouver region to Toronto, CPKC moved an average of 2027 containers per week.

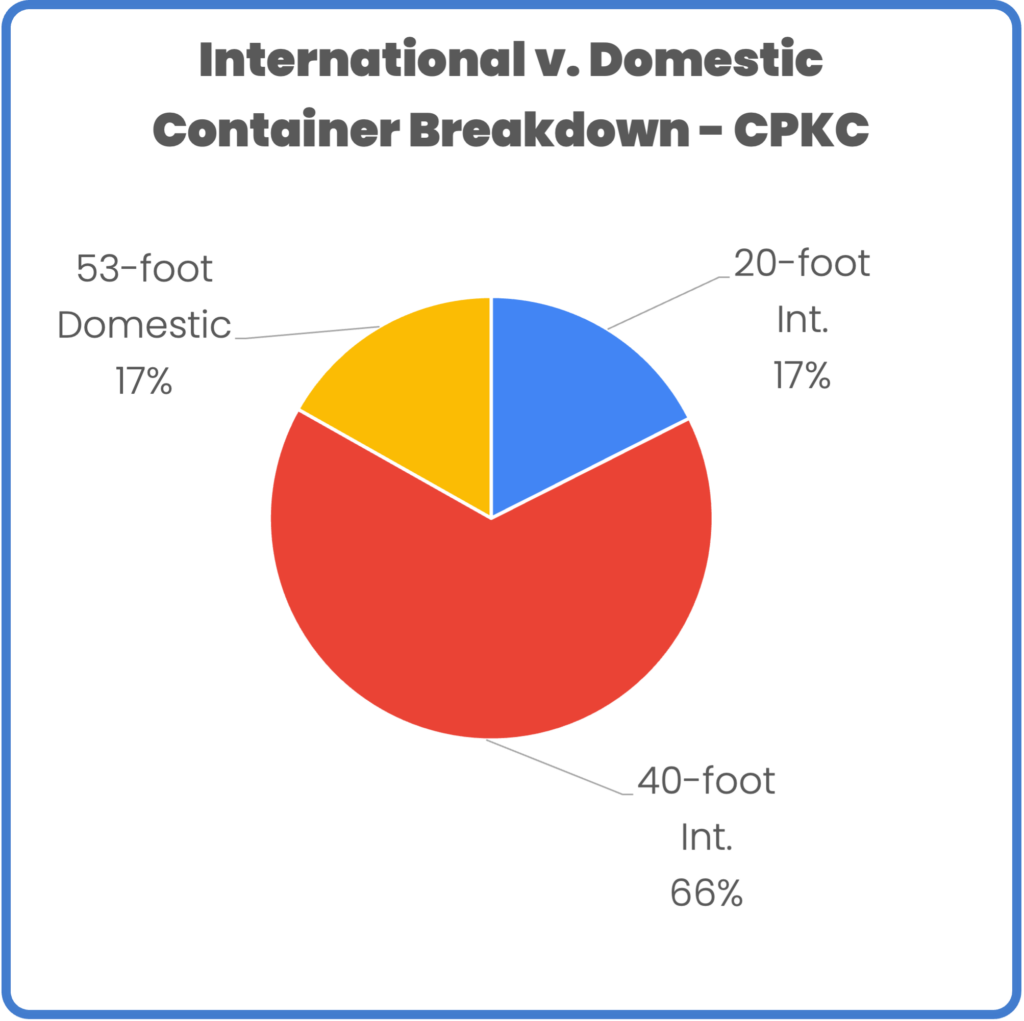

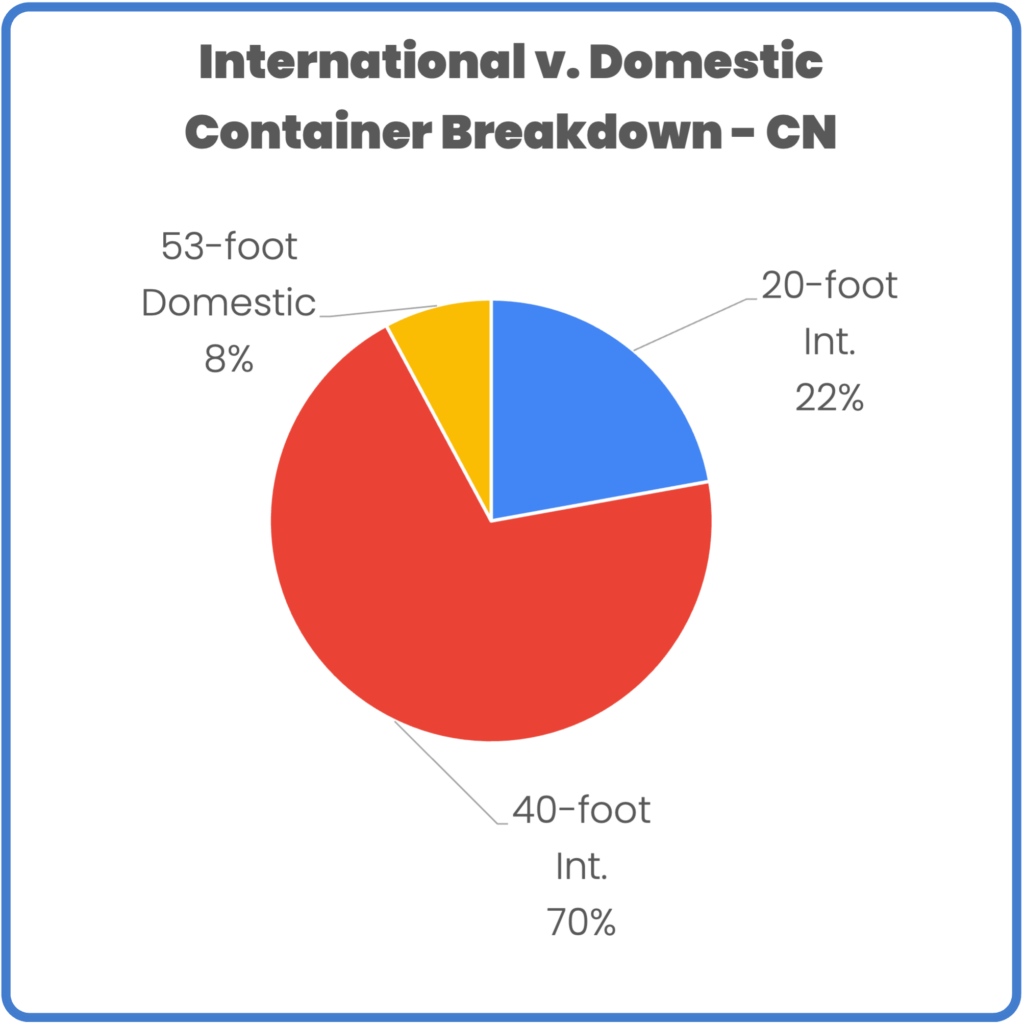

International 40-foot containers accounted for the vast majority of volume on both railroads, with CN posting a slightly higher proportion of 40-foot containers than CPKC, 70% to 66%. The biggest change in mix across both railroads was CN moving more 20-foot containers than in earlier months. In December, 20-foot containers accounted for 22% of CN’s intermodal volume, a 4-point change from November (18%).

Schedule your in-depth demo today to explore how Rail Network Intelligence can unlock insights for your rail supply chain.

Copyright © 2025 RailState LLC