Cross-Border Rail Volumes – March 5, 2025

RailState, the industry’s only provider of rail network intelligence independently monitors cross-border train movements in real-time.

Tariffs on goods from Canada and Mexico went into effect on March 4, and we’re monitoring the impact to rail volumes as they happen.

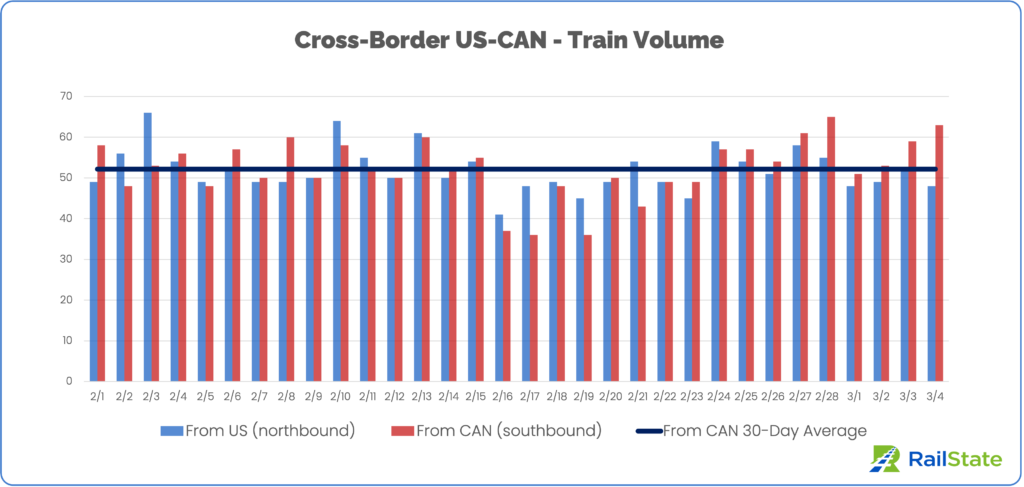

Train Volumes

Canada – US

Train volumes from Canada increased as the planned tariff date got closer and yesterday we saw some of the highest southbound train volumes in the past month.

There has been consistently more southbound volume from Canada into the US in recent days. Southbound train volumes compared to the 30-day average:

- Past 7 days: +11%

- March 4: +21%

The volume of railcars moving across the border from Canada has grown even more than train volumes. This is true across most commodity types, with the most recent 7-day average volumes up 17-31% above their 30-day average.

- Covered Hoppers: +31%

- Autoracks: +28%

- Gondolas: +24%

- Centerbeam Flatcars: +22%

- Box Cars: +20%

- Intermodal Stack Cars: +19%

- Tank Cars: +17%

Northbound train volumes from the US, on the other hand, have been slightly lower than the 30-day average.

- Past 7 days: -1%

- March 4: -8%

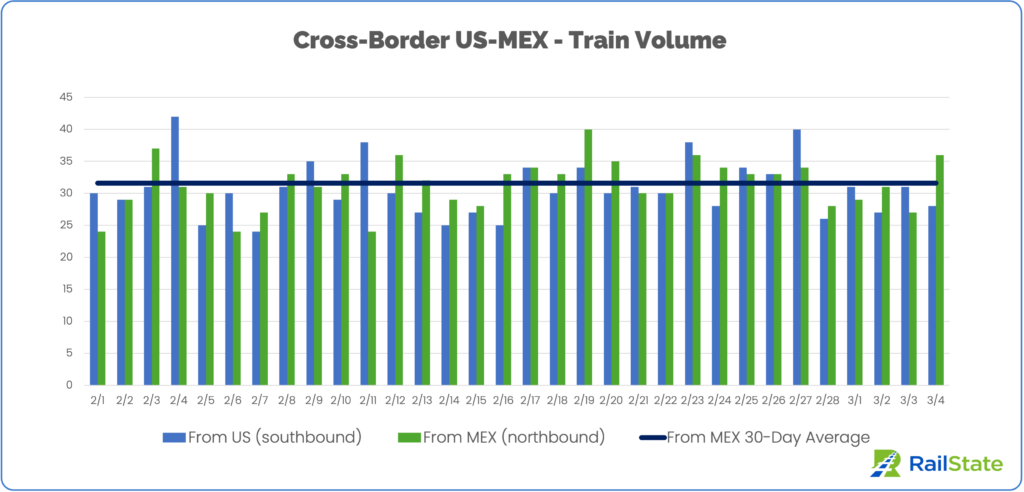

Mexico – US

Train volumes from Mexico into the US have also grown in recent days. Northbound train volumes compared to the 30-day average:

- Past 7 days: 14%

- March 4: -1%

Railcar volumes have also outpaced overall train volume changes across a number of commodity types.

Aside from grain movements, most railcar volumes have increased significantly over the past week compared to the 30-day average.

- Covered Hoppers: -3%

- Autoracks: +17%

- Gondolas: +22%

- Box Cars: +23%

- Intermodal Stack Cars: +19%

- Tank Cars: +7%

(Centerbeam flatcars account for minimal traffic across the southern border).

Southbound train volumes from the US, however, have fallen slightly in recent days. Compared to the 30-day average:

- Past 7 days: -9%

- March 4: 0%

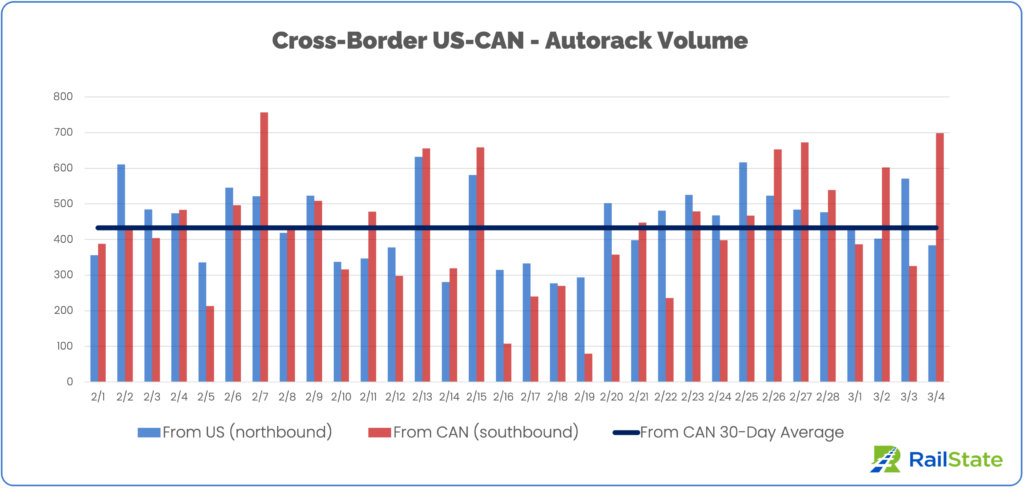

Autoracks

Canada – US

Autos have more cross-border complexity than other goods, with considerable movements of parts back and forth across the border and more original sources of materials that can differ down to the car model level.

A last minute reprieve pushed the tariffs on autos out one month, but recent southbound volumes from Canada show increased urgency to move more product in advance of the tariffs.

Compared to the 30-day southbound average:

- Past 7 days: +28%

- March 4: +61%

Northbound volumes from the US have not had a reciprocal trend. Compared to the 30-day northbound average:

- Past 7 days: +5%

- March 4: -14%

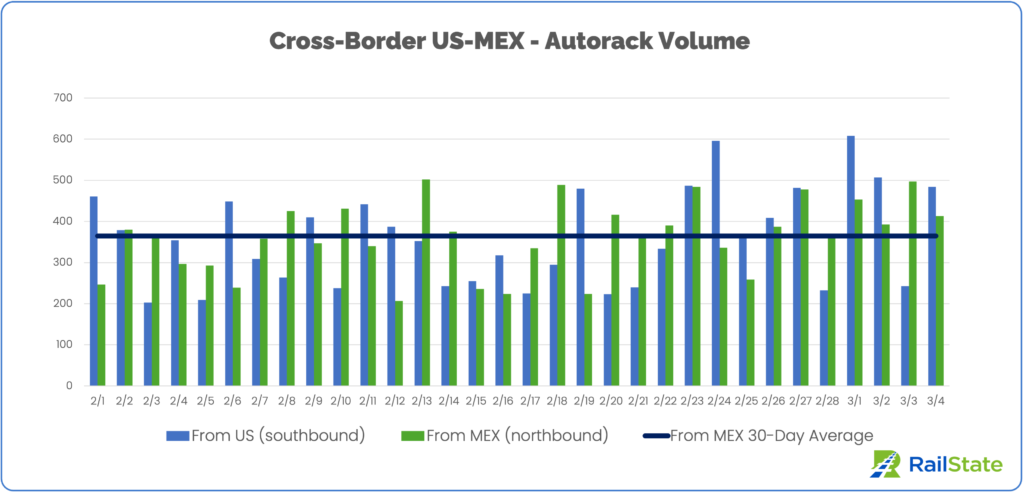

Mexico – US

Unlike the northern border, autorack volumes across the southern border are significantly up in both directions. For movements from Mexico into the US, compared to the 30-day northbound average:

- Past 7 days: 17%

- March 4: 13%

Southbound volumes from the US into Mexico have surprisingly grown even more, with volumes well above the 30-day average:

- Past 7 days: 23%

- March 4: 41%

We’ll continue regular reporting on cross-border impacts from tariffs as they happen.

For additional information about this report or to receive other updates from RailState, please reach out to contact@railstate.com or subscribe to our blog.