Canada Intermodal Rail Volume Report: January 2024

RailState, the rail industry’s only provider of real-time rail network visibility, independently tracks all freight rail movements across Canada in real-time.

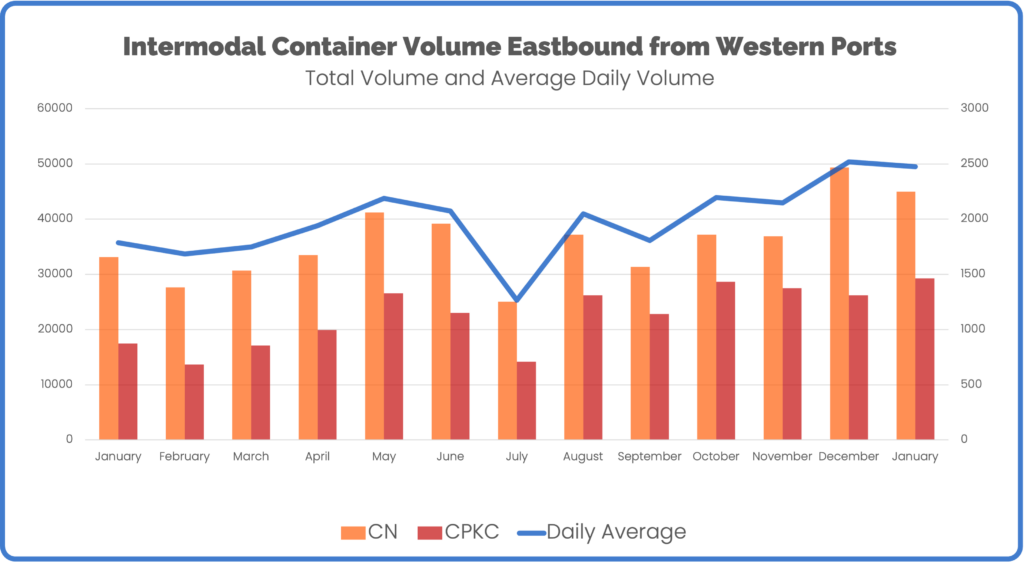

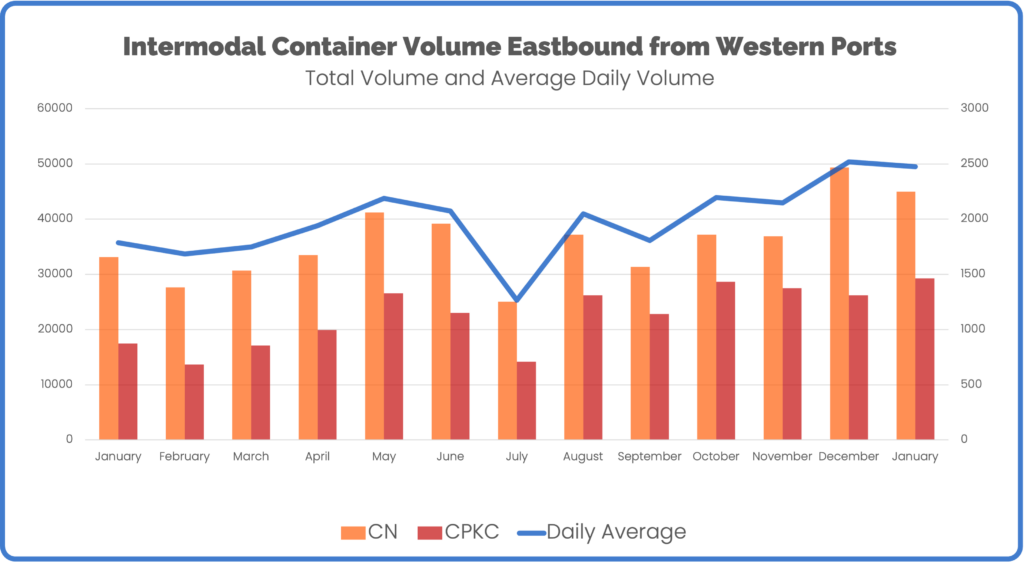

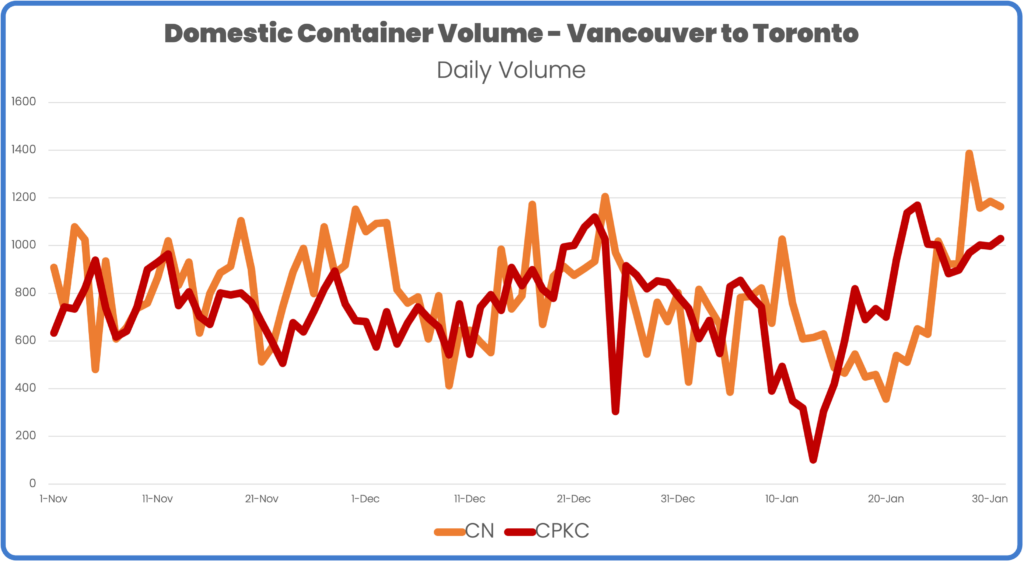

Total average daily volume headed eastbound from the Western Canada ports declined 1.7% in January compared to December.

CN decreased international intermodal volume 8.9% in January while CPKC increased 11.7%. CPKC took back some market share in January, moving 39.4% of international intermodal, up from 34.7% in December.

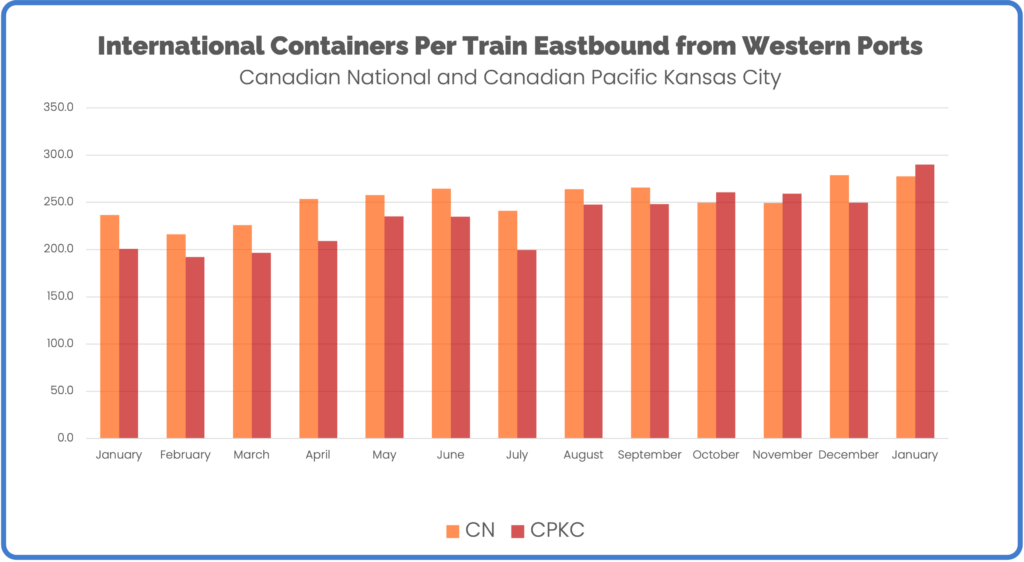

Explaining some of the growth in container volume for CPKC was increased train size. CPKC moved 4 fewer trains in January but increased containers per train by 16.1% from the month before.

Smaller trains were a necessity for all trains in the middle January due to a bout of extreme cold across western Canada, but train sizes rebounded at the end of the month.

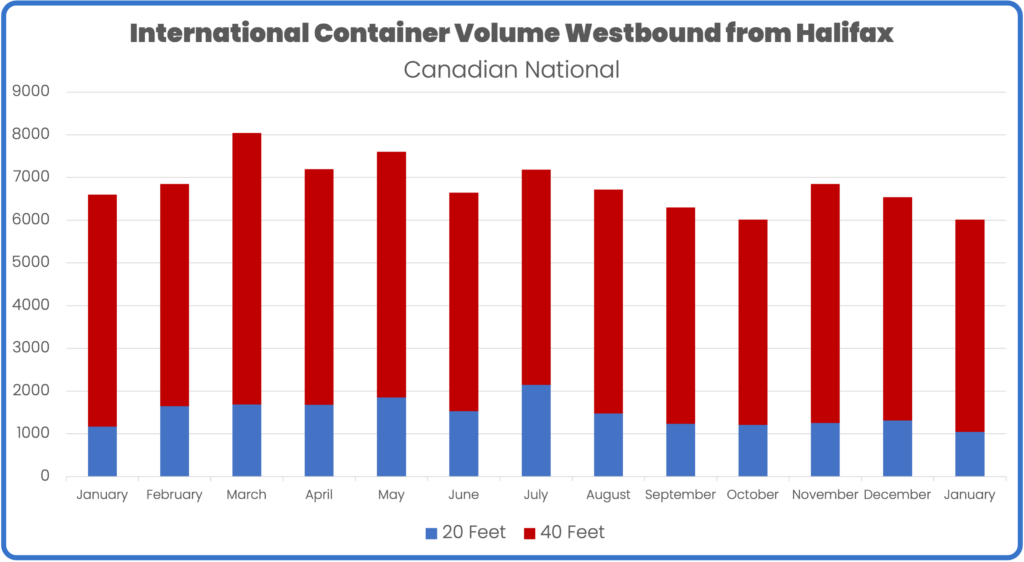

International container volume through Halifax declined again in January, decreasing 8.0% from the previous month.

Daily container volume from the Port of Vancouver region started the month in line with late December volumes. Volumes sank in the middle of the month in response to the extreme cold that limited train movements and required smaller train lengths.

The railroads were able to recover quickly and increase daily container movements well above the recent averages to close out January.

Schedule your in-depth demo today to explore how Rail Network Intelligence can unlock insights for your rail supply chain.

Copyright © 2025 RailState LLC