Western Ports Strike Special Report – Commodities Through the Ports Region – Through July 11

(July 12, 2023) – RailState, the rail industry’s only provider of real-time rail network visibility, independently tracks all freight rail movements across Canada, and as such, is uniquely positioned to observe the initial impacts on rail from the strike at the B.C. ports.

As the strike by the International Longshore and Warehouse Union Canada (ILWU Canada) enters its second week, RailState is closely monitoring the flows of rail traffic in the western ports region and the impact on rail traffic throughout Canada and into the United States.

Intermodal experienced the most immediate changes from the work stoppage, slowing to a halt soon after the start of the strike on July 1. Volume changes in other commodities, while not as immediate and stark as intermodal, are also showing a substantial impact from the strike.

Prince Rupert

Entering the Port on Rail

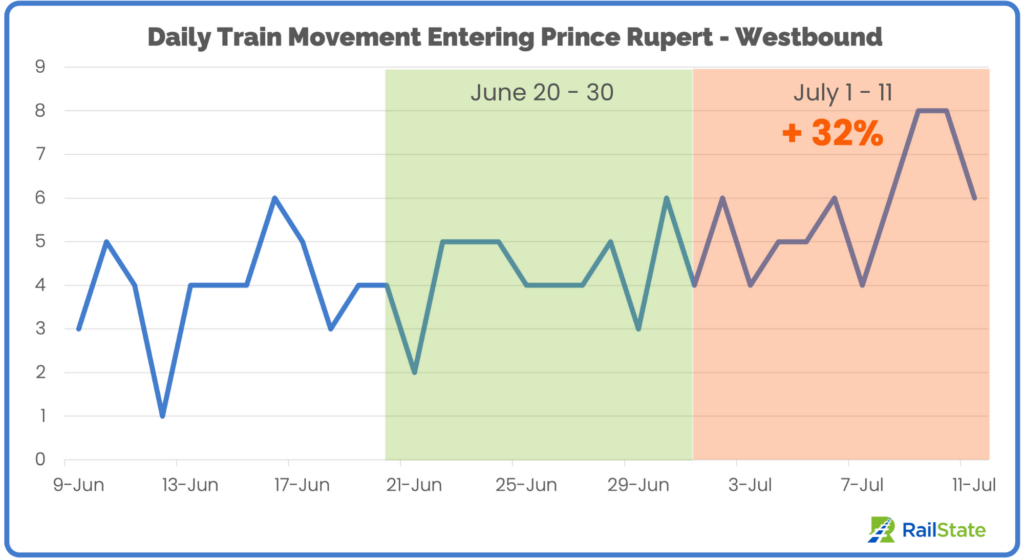

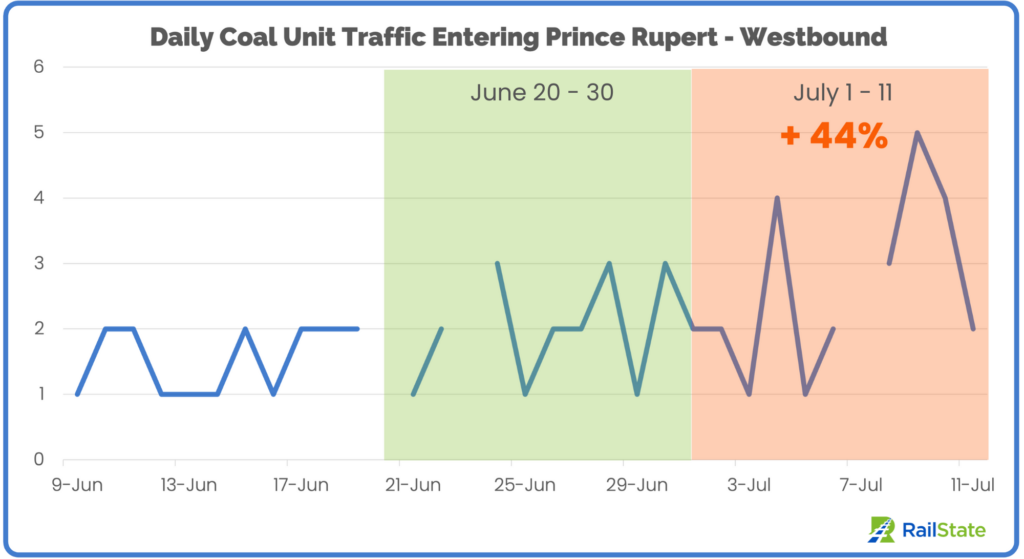

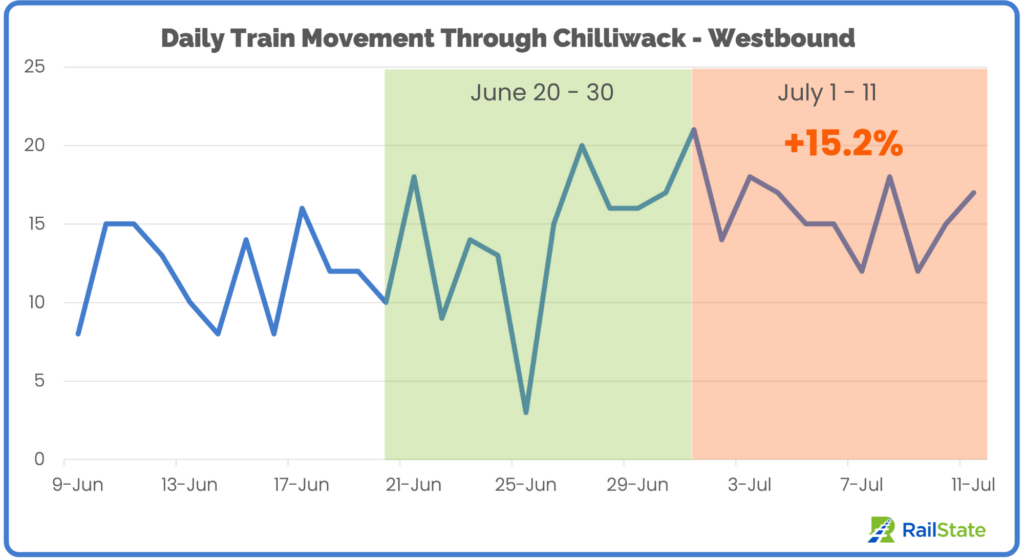

Traffic westbound into the port for export has increased since the start of the strike, due in large part to an increase in coal shipments. Total train volume is up 32% and total car volume is up 42%.

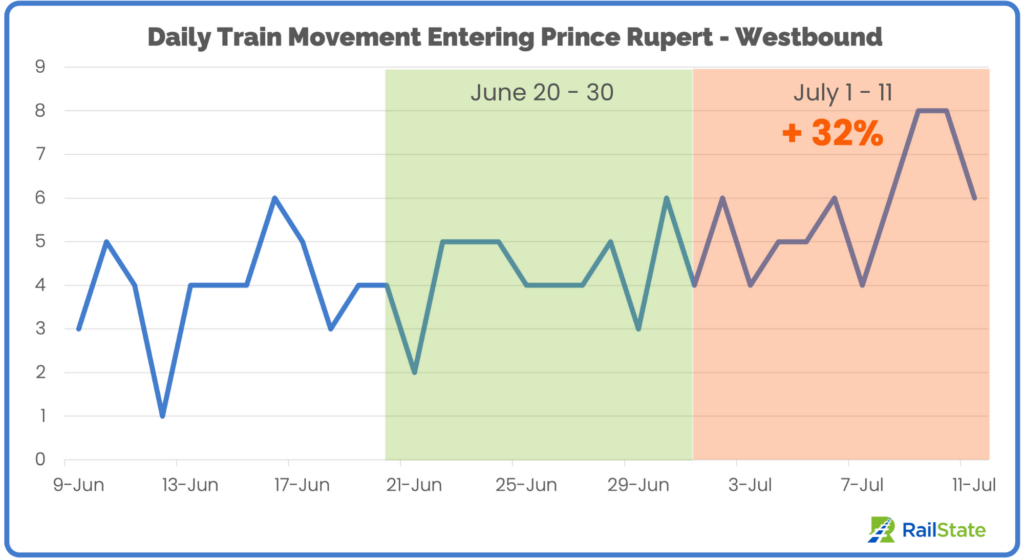

Coal unit train volume has increased 44% and total carloads are up 54.5%. Petroleum export volume has also increased, rising 25% in petroleum unit train volume and 24.1% in total tank car carloads since the start of the strike.

These commodities move through a terminal under a different contract than the one at stake in the ILWU actions at the other western ports, allowing them to continue operating.

Port of Vancouver

Entering the Port on Rail

Volume into the Port of Vancouver region has also increased, but to a lesser degree than at Prince Rupert.

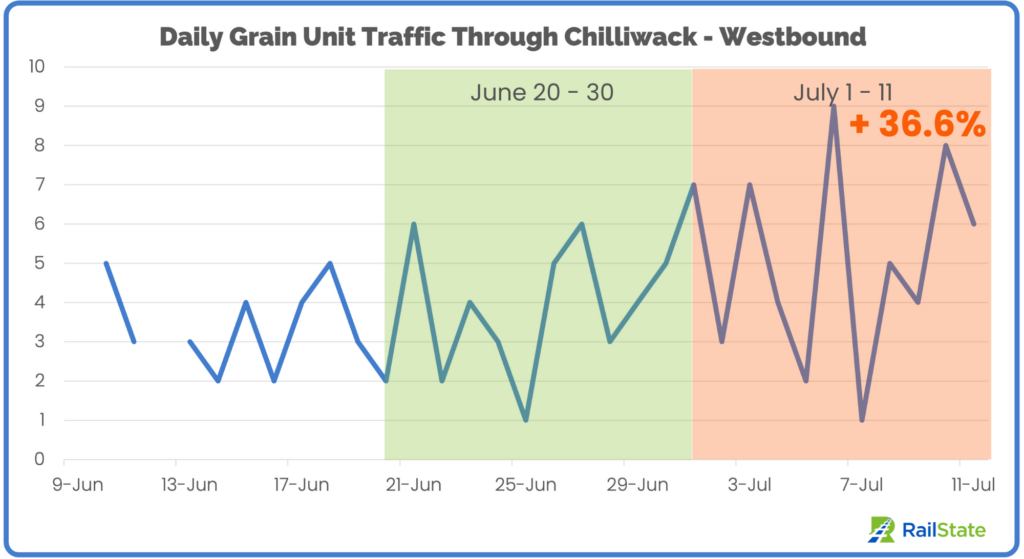

Grain unit train volume has seen a large increase, growing 36.6% in volume since the start of the strike. Grain is legally required to move, regardless of a work stoppage. However, there are questions about what specific levels of processing on grain shipments qualify under the federal exclusion that are currently being debated.

Continuous Updates

RailState will provide additional updates on the extended impact of the strike in the coming days and throughout the duration of the work stoppage, including reports on where rail traffic is moving, movements of bulk commodities, and flows southbound into the United States.

Subscribe here to receive these free reports as they are released. For shippers, analysts, and others looking for more information on rail network visibility and navigating rail operations during this and other disruptions, please reach out to contact@railstate.com.