Canada Ports Rail Volume Report: July 2024

RailState, the rail industry’s only provider of real-time rail network visibility, independently tracks all freight rail movements across Canada in real-time.

This report covers freight movements into the major Canadian ports. It excludes intermodal traffic, which is covered in a separate Intermodal Report.

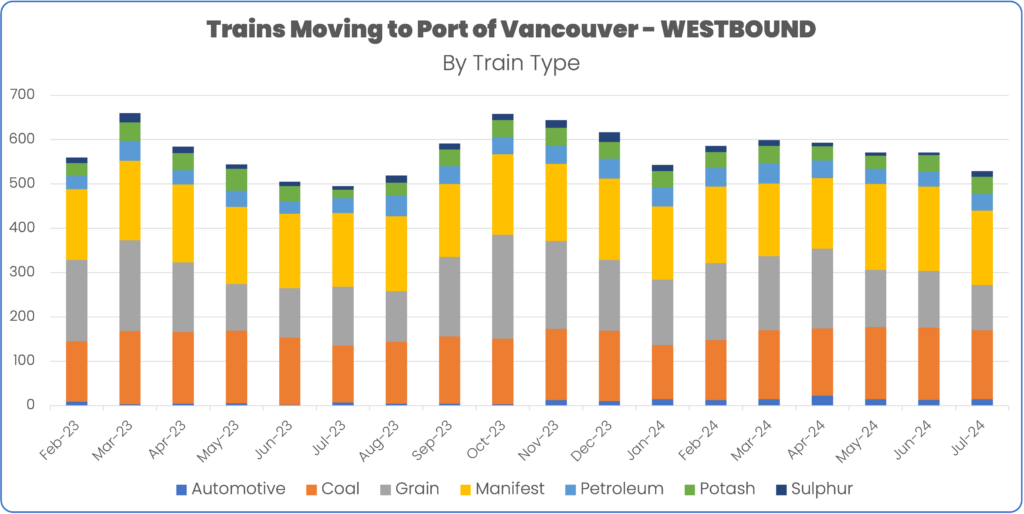

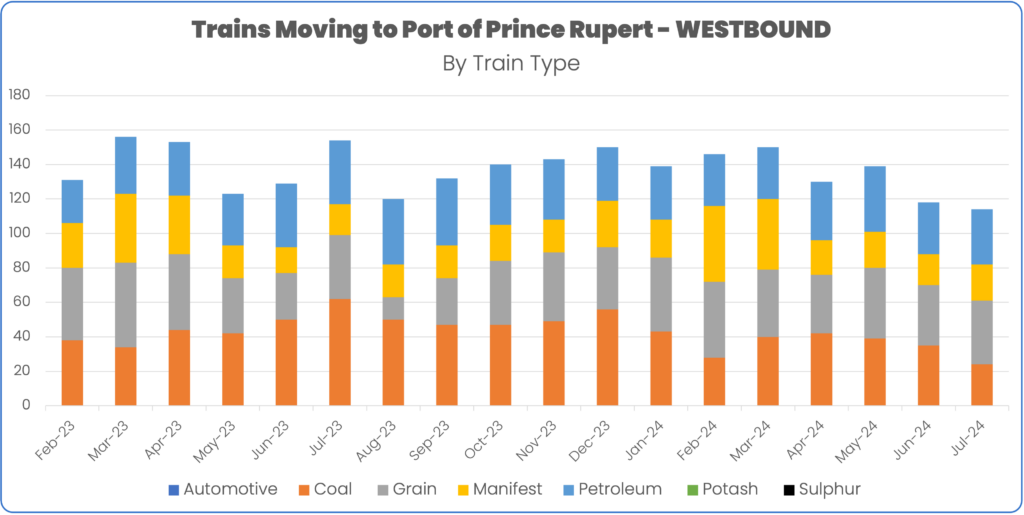

Overall freight volume westbound to the Port of Vancouver fell 7.4% compared to June, all driven by lower volumes on CN due to the Jasper Fire shutdown. The biggest % changes came from Grain Unit trains, which dropped 20.3%. Grain volume was impacted by the CN shutdown but July is also a seasonal low point for this traffic. Other train types showed mixed performance.

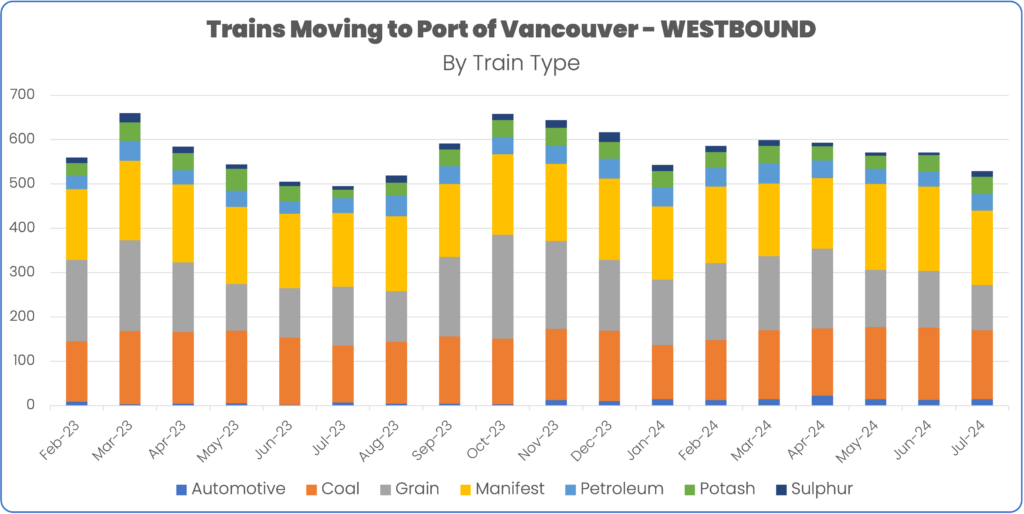

CPKC’s share of total carload volume into the Port of Vancouver region increased to 57.4% from 53.7% in June. This was also driven by lower volumes on CN from the main line shutdown.

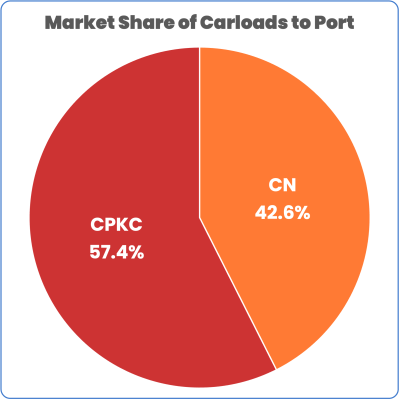

Freight volume to the Port of Prince Rupert fell 3.4% in July.

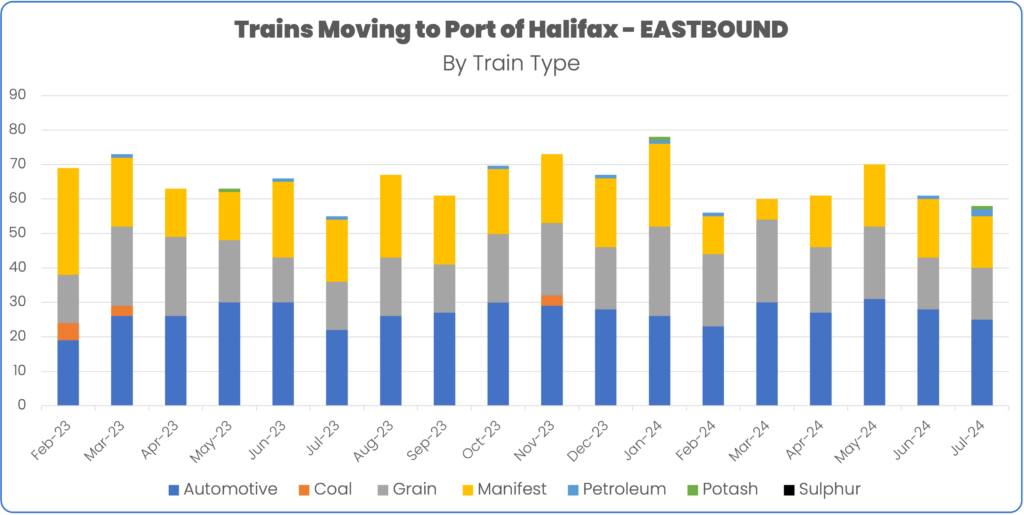

Train volume to Halifax decreased by 4.9% in July. All train types saw decreases in volume.

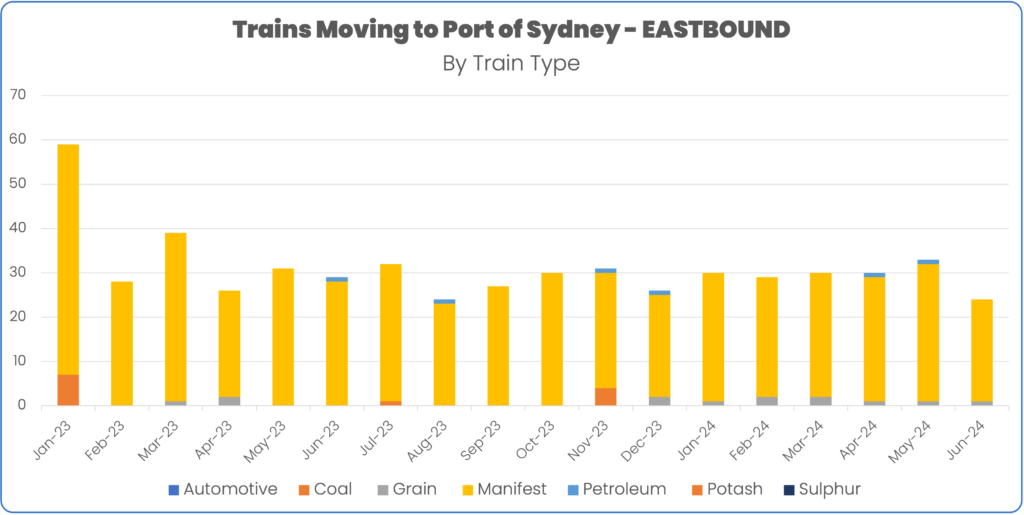

Train volume to the Port of Sydney decreased by 11 trains in June (-45.8%).

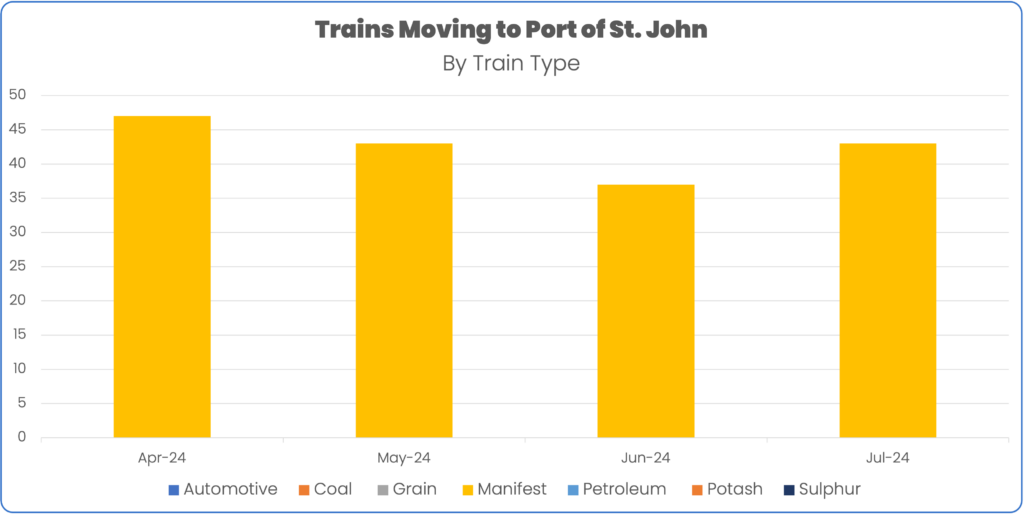

RailState recently added coverage for the Port of St. John, which sees all manifest volume. Train volume to the Port of St. John increased by 6 trains in July (+16.2%).

In July, the carload mix for the Port of St. John was:

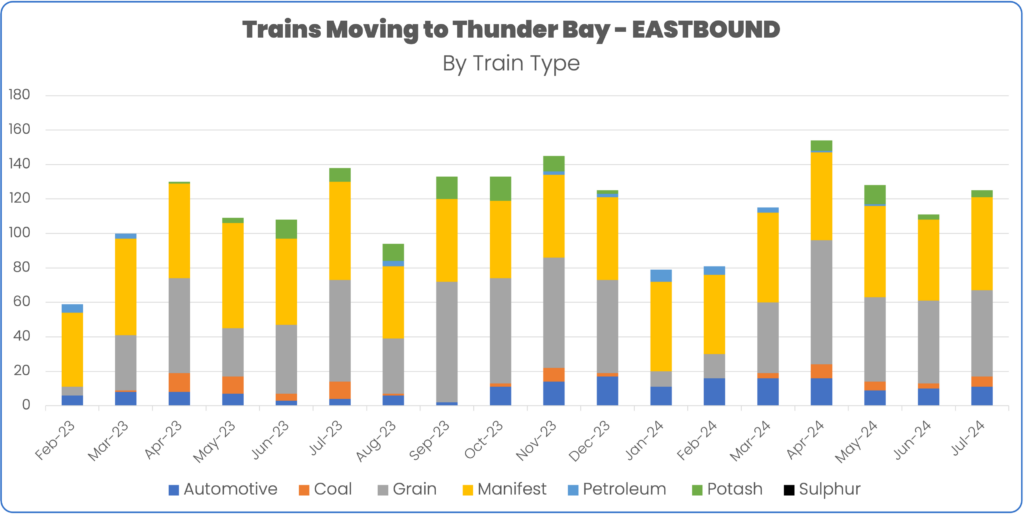

Train volume to Thunder Bay increased 12.6% in July.

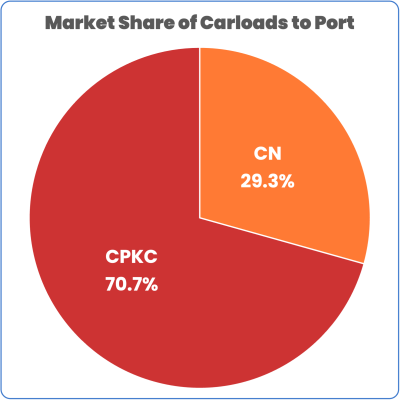

CN increased its market share of freight volume into the port, growing to 29.3% in July from 28.0% in June and 25.5% in May.

For additional information about this report or to receive other updates from RailState, please reach out to contact@railstate.com or subscribe to our blog.

Schedule your in-depth demo today to explore how Rail Network Intelligence can unlock insights for your rail supply chain.

Copyright © 2025 RailState LLC