Canada Intermodal Rail Volume Report: September 2024

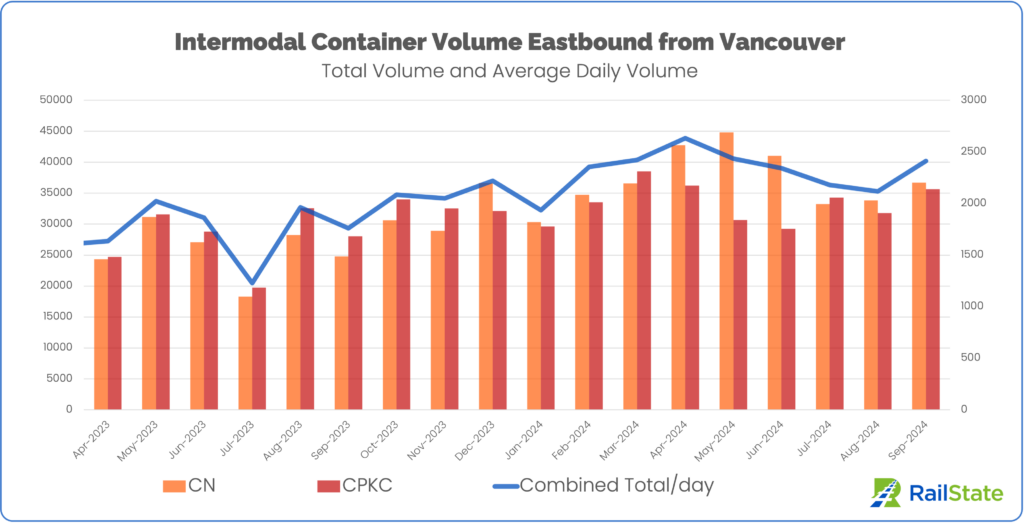

Combined container volume through the Port of Vancouver increased to 72,366 in September. This total was up 10.3% from August and 37.0% higher than September 2023.

CN container volumes through Vancouver were up 8.5% from August and 48.1% higher than a year ago.

CPKC’s total container volume was up 12.2% from August and up 27.2% from September 2023.

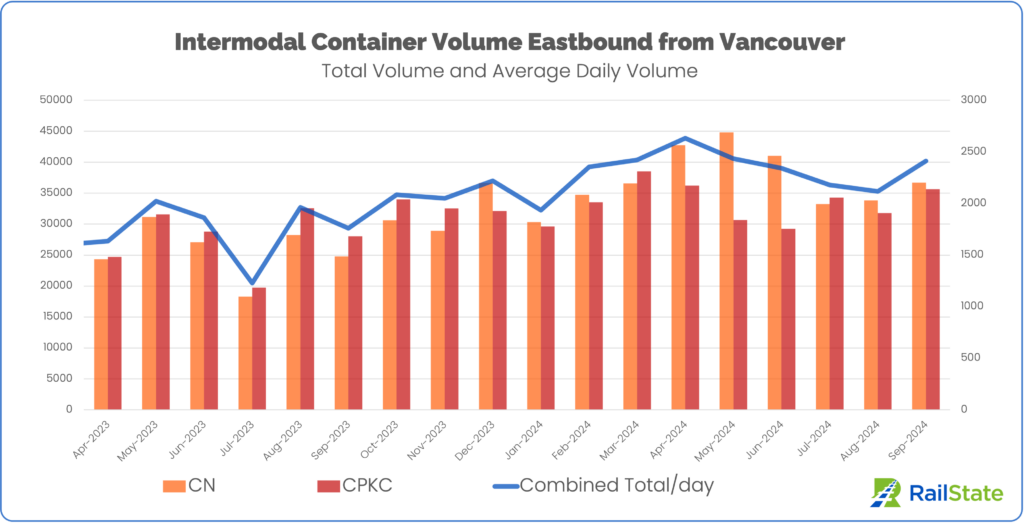

On-dock footage has decreased in recent weeks, according to the Port of Vancouver’s October 3 update, which coincides with both railroads moving significantly more platforms out of the port region.

Recent Surplus of Westbound Platforms v. Eastbound | ||

Week | CN | CPKC |

9/23/24 – 9/30/24 | (1,504) | (249) |

9/16/24 – 9/22/24 | (62) | (657) |

9/9/24 – 9/15/24 | 414 | 80 |

9/2/24 – 9/8/24 | (1,028) | (265) |

8/26/24 – 9/1/24 | 58 | 37 |

6-month weekly average | (1) | (1) |

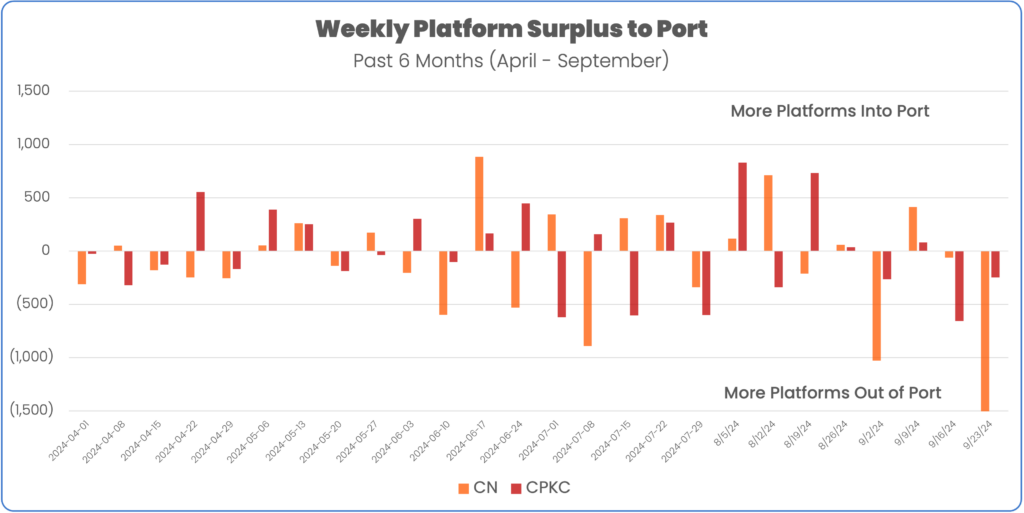

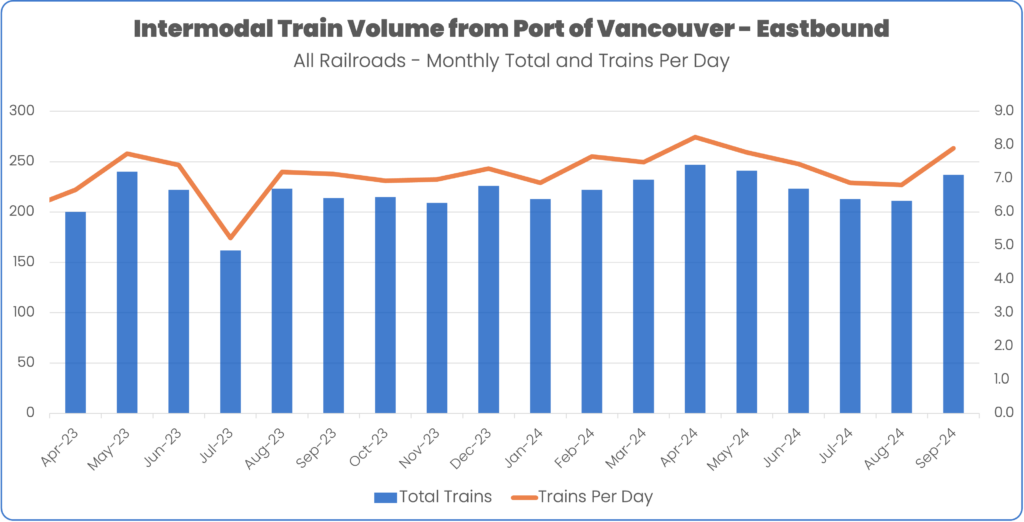

Total intermodal train volume out of the Port of Vancouver rose significantly after two months with significant network disruptions. There were 26 more trains (+12.3%) compared to August and 23 more trains (+10.7%) than September 2023.

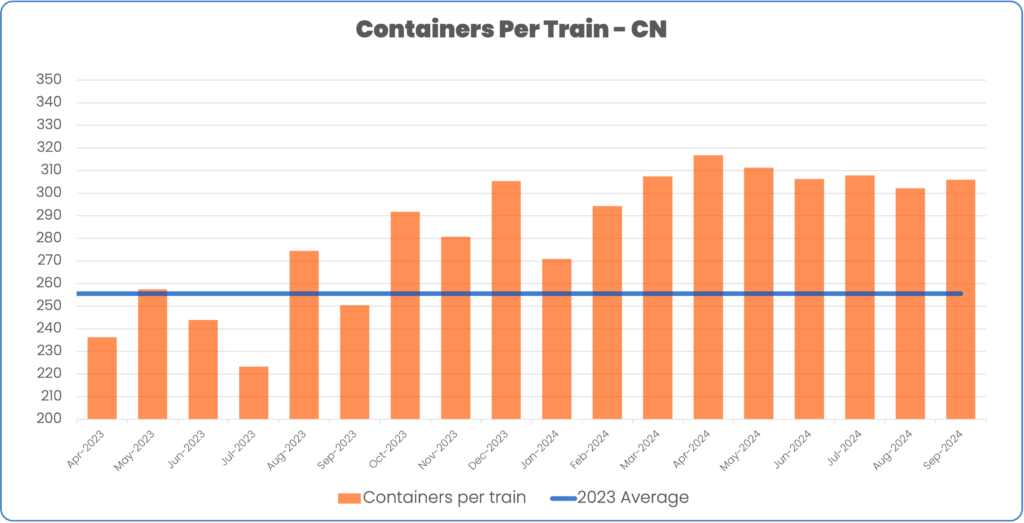

CN moved an average of 4 trains per day in September, up 10.7% from August. Train volume was up 21.2% from a year ago.

Average train size grew slightly from the prior month, with 2.5 more platforms per train, and 3.5 more containers per train. Compared to a year ago, CN trains carried 22.2% more containers per train.

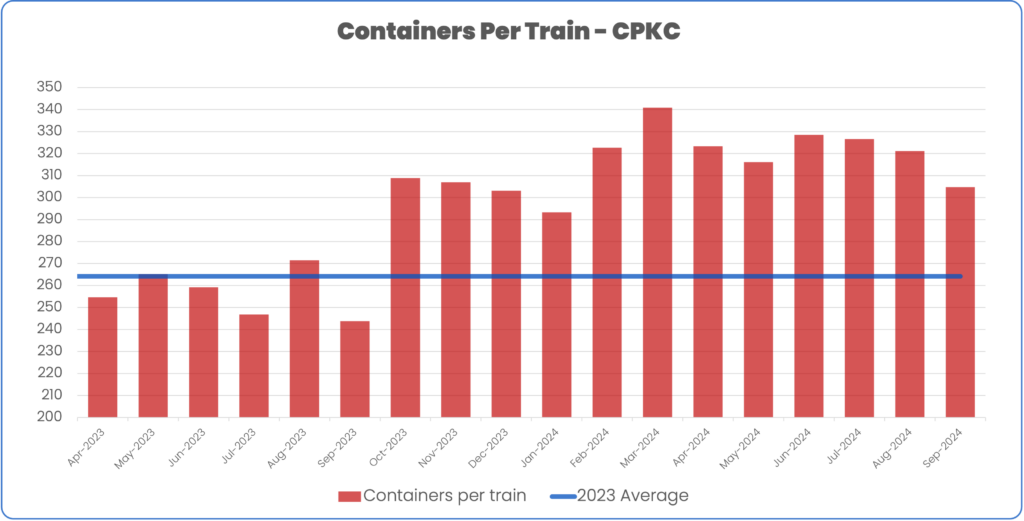

CPKC daily train volume in September was 22.1% higher than in August, and up 1.7% from September 2023. Average train size was slightly smaller in September, with 5 fewer platforms and 16 fewer containers per train.

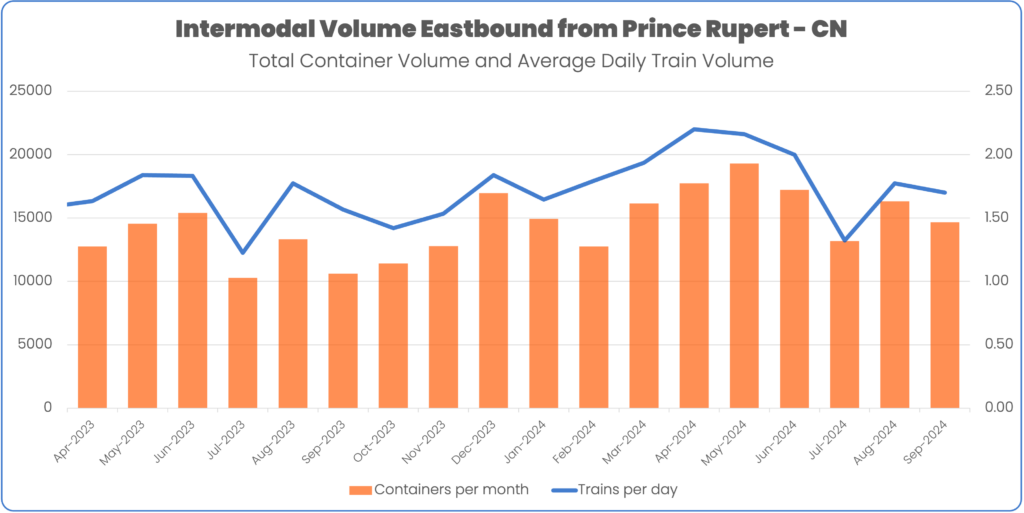

Container volume through Prince Rupert fell in September. Prince Rupert saw 14,661 containers, down 10.1% from August. Compared to a year ago, container volume was up 38.1%.

The increase in containers over last year came from more containers per train, 287.5 per train in September 2024 compared to 225.9 in September 2023, and additional trains, with 4 more trains this year.

For additional information about this report or to receive other updates from RailState, please reach out to contact@railstate.com or subscribe to our blog.

Schedule your in-depth demo today to explore how Rail Network Intelligence can unlock insights for your rail supply chain.

Copyright © 2025 RailState LLC