RailState Fills Critical Agriculture Data Gap – New Report on Grain Train Utilization

UP Increases Grain Volumes while BNSF Makes Efficiency Gains

The extended federal government shutdown has left grain shippers without access to critical performance data they rely on for planning and operations. For decades, the USDA’s Agricultural Transportation Service has published weekly shuttle turns per train—key metrics that help grain elevators, traders, and logistics planners understand how efficiently rail equipment cycles through the network. With that data now unavailable, the agricultural rail market faces a significant blind spot at a crucial time in the grain shipping season.

RailState is stepping in to fill this gap with independent, real-time data collected from its proprietary network of more than 280 trackside sensors deployed across North America. Unlike government statistics that aggregate carrier-reported data, RailState captures train movements by carrier and lane-by-lane, providing visibility into metrics that have never been publicly available.

Key Findings Through October 31

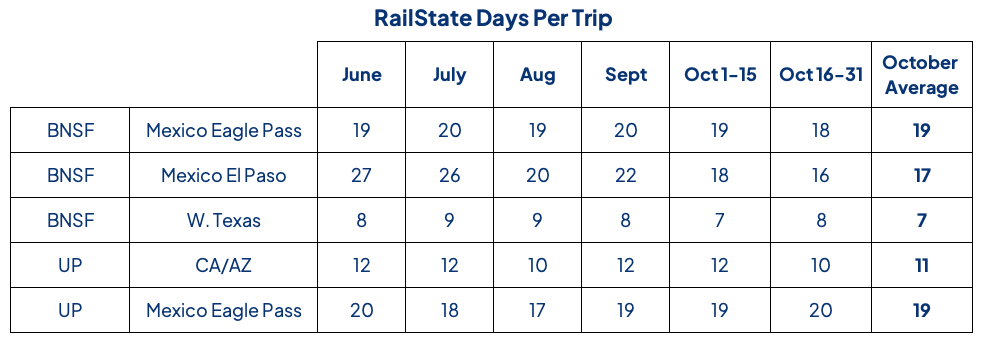

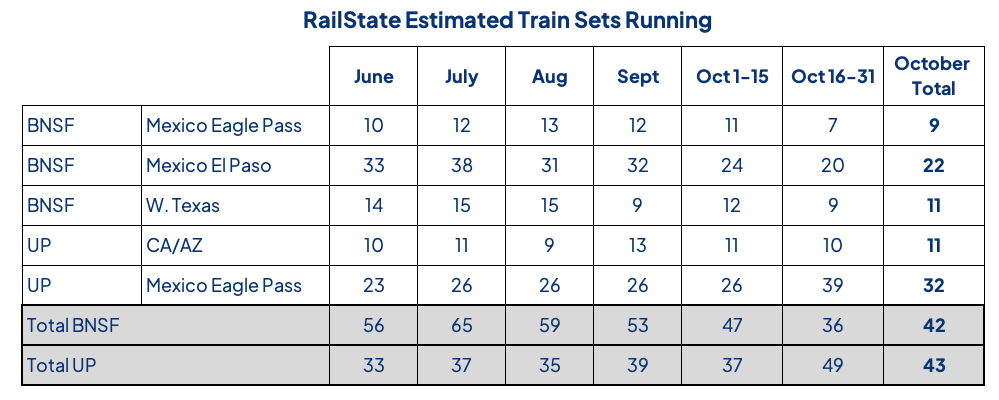

The latest RailState data reveals notable differences in performance between the two major western grain carriers, Union Pacific and BNSF, driven by distinct operational patterns and market demands.

With better velocity, BNSF’s total trainset requirements declined from approximately 53 trainsets in September to 42 in October.

Key Value of RailState Data

Independent Data for Objective Analysis

RailState’s independence from railroad operators and other industry participants creates a distinct advantage for validating train asset performance. RailState operates its own sensor network deployed across grain corridors rather than relying on carrier-reported metrics or third-party data feeds. This means the data reflects actual network conditions, available immediately as things happen.

For shippers evaluating equipment participation in secondary rail car markets, this independence is critical. Turn time metrics and trainset utilization figures directly influence capital decisions—they determine whether to acquire additional equipment, where to position it, and at what cost. Decisions based on incomplete or potentially biased data can be costly. RailState’s direct observation of train movements, speeds, and corridor performance provides the transparency needed to make asset decisions with confidence.

As government data services have encountered delays, RailState continues expanding its sensor coverage across grain routes, with plans to provide comprehensive data on Pacific Northwest corridors and additional regions. For an industry navigating both harvest logistics and unprecedented data uncertainty, independent real-time intelligence has become an essential tool for operational planning and market strategy.

25 Comments

Comments are closed.

… [Trackback]

[…] Find More Informations here: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]

… [Trackback]

[…] Find More Information here on that Topic: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]

… [Trackback]

[…] Info on that Topic: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]

… [Trackback]

[…] Find More to that Topic: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]

… [Trackback]

[…] Find More to that Topic: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]

… [Trackback]

[…] Info on that Topic: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]

… [Trackback]

[…] Read More Information here on that Topic: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]

… [Trackback]

[…] Info on that Topic: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]

… [Trackback]

[…] Find More on to that Topic: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]

… [Trackback]

[…] Read More here on that Topic: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]

… [Trackback]

[…] Find More on that Topic: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]

… [Trackback]

[…] Read More Info here on that Topic: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]

… [Trackback]

[…] There you will find 37111 more Info on that Topic: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]

… [Trackback]

[…] There you will find 47825 more Information on that Topic: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]

… [Trackback]

[…] Read More to that Topic: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]

… [Trackback]

[…] Read More Information here to that Topic: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]

… [Trackback]

[…] Read More Info here on that Topic: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]

… [Trackback]

[…] Read More Information here to that Topic: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]

… [Trackback]

[…] Find More to that Topic: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]

… [Trackback]

[…] Read More here to that Topic: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]

… [Trackback]

[…] Find More Info here on that Topic: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]

… [Trackback]

[…] Find More to that Topic: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]

… [Trackback]

[…] Information to that Topic: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]

… [Trackback]

[…] Read More Information here on that Topic: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]

… [Trackback]

[…] Here you will find 82801 additional Information on that Topic: railstate.com/railstate-fills-critical-agriculture-data-gap-new-report-on-grain-train-utilization/ […]